Navigating Stability The Impact of Investment Grades

Investment Grades, issued by rating agencies, serve as vital indicators of safety for investors eyeing bonds from countries or companies. These classifications offer insight into an entity’s reliability, aiding investors’ decision-making.

Advertising

They assess creditworthiness based on financial performance, economic stability, and debt repayment history. Higher grades mean lower risk and reduced borrowing costs, fostering confidence and stability in markets.

Advertising

Crucial for global finance, Investment Grades guide investors, influence economic strategies, and impact countries’ financial stability. Understanding their significance is essential for navigating the complex financial landscape and ensuring a secure financial future.

What are Investment Grades?

Investment Grades, classified by rating agencies, signify the safety of investing in bonds issued by countries or companies. This classification acts as a “quality seal,” revealing the reliability level of a specific entity to investors.

Advertising

Essentially, Investment Grades assess creditworthiness based on financial performance, economic stability, and debt repayment history, aiding investors in informed decision-making.

Higher grades translate to lower risk and reduced borrowing costs, fostering confidence and stability in financial markets.

What are Investment Grades used for?

Investment Grades play a crucial role in the global financial market. They provide an objective reference for investors to assess the risk associated with a particular investment.

Countries or companies with Investment Grades usually have access to lower interest rates and more favorable financing conditions, as they are considered less risky.

What are the criteria for determining Investment Grades?

When determining Investment Grades, rating agencies assess various factors such as economic stability, debt repayment history, revenue generation capacity, and fiscal and monetary policies.

These criteria provide insights into a country’s financial health and creditworthiness, guiding investment decisions and economic strategies.

How are Investment Grades calculated?

Investment Grades are calculated based on a comprehensive analysis of various economic and financial indicators. Rating agencies assign grades or letters to countries or companies, indicating their level of solvency and ability to honor their financial commitments.

Step-by-step to calculate Investment Grades:

- Collection of relevant economic and financial data.

- Detailed analysis of the economic and fiscal situation of the country or company.

- Assignment of a grade or classification based on the criteria established by the rating agency.

What are the benefits of obtaining Investment Grades?

Securing Investment Grades yields numerous benefits. It grants broader access to global capital markets, lowers borrowing costs, boosts investor confidence, and fosters favorable financial conditions.

This translates into enhanced liquidity, increased investment opportunities, and greater economic stability. Additionally, Investment Grades enhance credibility and attract more investment inflows, solidifying entities’ reputation as reliable and creditworthy.

Ultimately, they signify sound financial management, instilling trust among investors and positioning entities for long-term success in the global market.

Which countries have Investment Grades?

Numerous developed and economically stable nations hold Investment Grades, showcasing their robust financial management. Countries like the United States, Germany, Japan, Canada, and others have consistently maintained favorable ratings, reflecting their resilience in economic challenges.

Additionally, nations across continents such as France, the United Kingdom, Switzerland, South Korea, Singapore, Brazil, Mexico, Chile, the United Arab Emirates, and Qatar also boast Investment Grades, underscoring their commitment to stability and attractiveness to global investors.

What are the most recognized rating agencies?

The most esteemed rating agencies in the financial world include Standard & Poor’s, Moody’s Investors Service, and Fitch Ratings. These agencies hold significant influence in assigning Investment Grades, guiding investors’ decisions globally.

Their assessments are closely monitored and trusted by investors, governments, and financial institutions, shaping perceptions of creditworthiness and risk in the global marketplace.

What is the importance of Investment Grades for a country?

Investment Grades are paramount for countries, significantly influencing their economic stability and growth prospects. These ratings serve as a gauge of a nation’s creditworthiness, determining its ability to secure financing from international markets.

Countries with favorable Investment Grades enjoy easier access to capital at lower interest rates, enabling them to invest in critical infrastructure, social programs, and economic initiatives.

Additionally, a high rating signals stability and reliability to foreign investors, attracting inflows of foreign capital that fuel economic expansion and job creation.

Moreover, Investment Grades play a crucial role in bolstering a country’s reputation and credibility on the global stage. Nations with strong credit ratings are viewed as more trustworthy and financially responsible, fostering confidence among investors, lenders, and trading partners.

This confidence can have ripple effects throughout the economy, spurring increased investment, trade opportunities, and overall economic prosperity. Thus, Investment Grades are not only indicators of financial health but also powerful drivers of economic development and international competitiveness.

How do Investment Grades affect investors?

Investment Grades have a significant impact on investors by providing valuable risk assessment insights and influencing their asset allocation decisions. Investors tend to favor assets with higher Investment Grades due to the perceived security and stability they offer.

This preference shapes investment trends and market sentiment, impacting asset prices and market dynamics. Additionally, investing in countries or companies with Investment Grades can offer attractive long-term return potential, contributing to sustained growth and wealth accumulation for investors focused on achieving their financial goals.

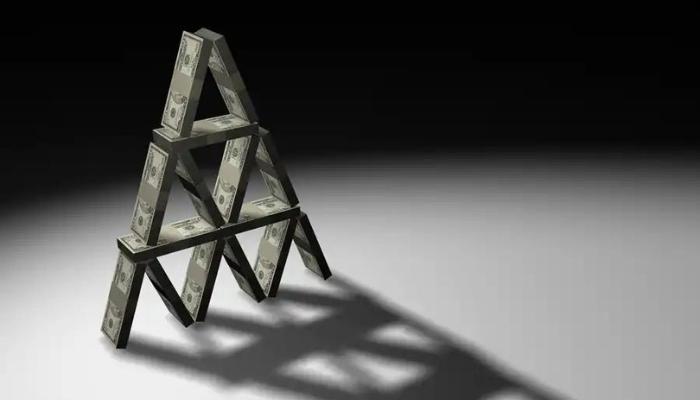

What are the consequences of losing the Investment Grade?

Losing the Investment Grade can have significant consequences for a country or company. This can result in higher interest rates, difficulty in accessing the capital market, investor distrust, and in extreme cases, economic crises.

Losing the Investment Grade can also lead to depreciation of the local currency, increased inflation, and financial instability.

To avoid losing the Investment Grade, countries and companies must maintain strong economic policies, promote sustainable growth, maintain a reliable debt repayment history, and take measures to strengthen financial stability.

In summary, Investment Grades play a fundamental role in the global financial market, providing an objective measure of the risk associated with specific investments. They influence investors’ decisions, affect access to financing, and have a significant impact on the economic stability of a country or company.

Therefore, understanding what Investment Grades are, what they’re used for, and how they’re calculated is essential for investors, companies, and governments worldwide. Stay informed and make informed financial decisions to protect your investments and ensure a solid financial future.