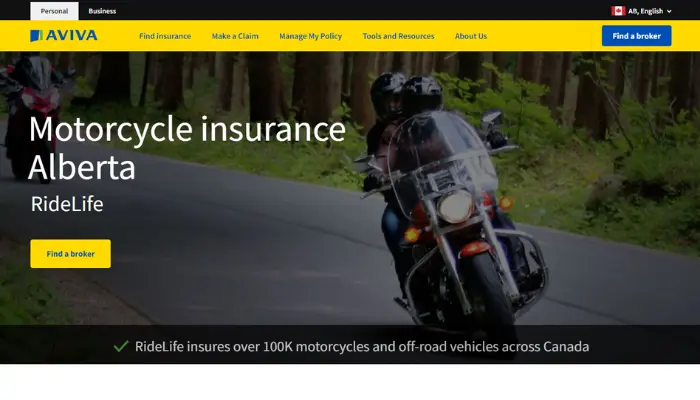

Discover Aviva Canada’s Top Insurance Plans in 2024

Are you looking for ways to protect your motorcycle and ensure a safe ride? Aviva Canada might be the solution.

Advertising

A variety of customizable coverage options, designed to meet your needs, are available at Aviva Canada, along with substantial discounts and quality support.

Advertising

In the realm of motorcycle insurance, Aviva Canada is definitely excellent. Here we present all the essential details you need to know about Aviva Canada motorcycle insurance: from coverage options to how claims are processed. Keep reading and decide if this works for you!

Coverage Options

When it comes to choosing motorcycle insurance, Aviva Canada offers a variety of options to meet your individual needs. Here are some of the main coverages available:

Advertising

Comprehensive Coverage: This coverage protects your motorcycle against damage caused by collisions, theft, vandalism, and natural disasters. It is ideal for those who want complete protection against unforeseen events.

Collision Coverage: Focused on damage caused by collisions with other vehicles or objects, this coverage is essential for those who use their motorcycle daily and want protection against road accidents.

Liability Coverage: Protects you against damage to third parties and their properties. It is mandatory coverage that ensures you are financially protected if you cause an accident that results in damage to other people or property.

Personal Effects Coverage: Includes protection for your personal items that are transported on the motorcycle, such as helmets, jackets, and other accessories.

Waiver of Depreciation: This coverage ensures that, in the event of a total loss of the motorcycle, you receive the full amount paid for the motorcycle without depreciation.

Discounts and Savings

Aviva Canada offers several discounts and savings opportunities to make your motorcycle insurance more affordable. Here are some ways to save:

Safe Driver Discounts: Drivers with a clean driving record may qualify for significant discounts. If you have a good driving history, inquire about how this can reduce your premiums.

Multi-Policy Discounts: If you have more than one policy with Aviva Canada, such as home or auto insurance, you can benefit from additional discounts. Bundling your policies is a great way to save.

Custom Motorcycle Discounts: Owners of custom motorcycles can receive discounts by insuring their accessories and custom parts.

Safe Riding Training Program: Completing safe riding courses can not only improve your riding skills but also result in discounts on your motorcycle insurance.

Claims Process

Aviva Canada prides itself on offering a simple and efficient claims process. Here is a step-by-step guide on how to file a claim:

1. Report the Claim Immediately: In case of an accident or damage, contact Aviva Canada as soon as possible. You can call their 24/7 hotline or file the claim online.

2. Provide Accurate Details: When reporting the claim, provide all relevant details, including the date, time, location, and a description of the incident. The more information you provide, the faster your claim will be processed.

3. Submit Necessary Documents: Prepare and submit any required documentation, such as photos of the damage, police reports, and repair estimates.

4. Track the Claim: Use Aviva’s online portal or app to track the status of your claim in real time. This ensures transparency and keeps you informed throughout the process.

Optional Endorsements

For even more comprehensive protection, Aviva Canada offers several optional endorsements that can be added to your policy. Some of these endorsements include:

Accessory Coverage: Additional protection for custom parts and accessories on your motorcycle. This is especially useful for custom bikes with valuable parts.

Trip Interruption Coverage: Covers expenses related to lodging, meals, and transportation if your motorcycle breaks down during a trip.

Trailer and Side-Car Coverage: Protection for trailers and side-cars used to transport your motorcycle.

Customization for Specific Needs

Aviva Canada understands that every motorcyclist is unique and has specific needs. Therefore, they offer flexibility in customizing policies:

High-Value Motorcycles: If you own a high-value or classic motorcycle, you can opt for special coverages that ensure replacement or repair without considering depreciation.

Custom Motorcycles: For those who like to personalize their bikes, Aviva offers coverages that include all modifications made to the motorcycle, ensuring your investment is protected.

Temporary Insurance: If you only use your motorcycle during certain times of the year, such as summer, Aviva offers temporary insurance options or seasonal adjustments, allowing you to save during the months your motorcycle is stored.

Roadside Assistance

Aviva Canada offers 24/7 roadside assistance to ensure you are never stranded in an emergency. Here are some of the services available:

Towing: If your motorcycle breaks down, you can request towing service to the nearest repair shop.

Battery Jump: Battery jump service to ensure you are not stranded due to a simple electrical issue.

Tire Change: Assistance with changing tires in case of a flat or damage.

Fuel Delivery: Fuel delivery service in case you run out of gas during a ride.

Seasonal Adjustments

If you do not use your motorcycle during the winter months, Aviva Canada offers seasonal adjustments to save on annual insurance:

Lay-Up Insurance: During the winter, you can opt for insurance that covers your motorcycle against theft and damage while stored, but does not cover road accidents. This can significantly reduce insurance costs.

Coverage Reduction: Adjust your coverage to reflect seasonal use, reducing protection during the months the motorcycle is not in use, but ensuring full protection when you start riding again.

Aviva Canada shines as the top choice for motorcycle owners across the country, given its vast array of coverage and customization options.

To ensure the best policy that offers protection and peace of mind while traveling, take a look at the different coverages available to you, including any discounts you may qualify for, as well as the ease of the claims process.

Choose wisely and enjoy the pleasure of navigating any road, knowing that you will be well taken care of by Aviva Canada.