Firstcard Secured Credit Builder Card: Your Ultimate Guide to Rebuilding Credit

If you’re looking to rebuild your credit or start building it from scratch, the Firstcard Secured Credit Builder Card might be the perfect solution. This card is designed to help you improve your credit score while offering practical features to manage your finances.

Advertising

In this guide, we’ll break down everything you need to know about the Firstcard Secured Credit Builder Card, from how it works to tips for maximizing its benefits. Let’s get started!

What is the Firstcard Secured Credit Builder Card?

Advertising

TheFirstcard Secured Credit Builder Card is a secured credit card tailored for individuals with no credit history or those looking to rebuild their credit. Unlike traditional credit cards, it requires a security deposit, which acts as your credit limit. This makes it a low-risk option for both the cardholder and the issuer.

Advertising

What sets this card apart is its focus on helping users build credit while offering tools and features to manage spending effectively. Plus, it reports to all three major credit bureaus (Equifax, Experian, and TransUnion), so responsible use can positively impact your credit score over time.

How Does the Firstcard Secured Credit Builder Card Work?

1. Security Deposit and Credit Limit

To open an account, you’ll need to make a security deposit, typically ranging from 200to2,000. This deposit determines your credit limit. For example, if you deposit 500,yourcreditlimitwillbe500.

2. Credit Reporting

Firstcard reports your payment history and credit usage to the three major credit bureaus. This means that by using the card responsibly—paying on time and keeping your balance low—you can build or rebuild your credit score.

3. No Credit Check

Since this is a secured card, there’s no hard credit check during the application process. This makes it accessible to people with poor or no credit history.

Benefits of the Firstcard Secured Credit Builder Card

Why choose this card? Here are the top benefits:

- Credit Building: Designed specifically to help you improve your credit score.

- Low Deposit Requirement: Start with a deposit as low as $200.

- No Annual Fee: Save money compared to other secured cards that charge annual fees.

- Mobile App Access: Manage your account, track spending, and make payments on the go.

- Credit Education Resources: Firstcard provides tools and tips to help you understand and improve your credit.

How to Apply for the Firstcard Secured Credit Builder Card

Applying for the card is straightforward. Follow these steps:

- Check Eligibility: You must be at least 18 years old and have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Prepare Your Deposit: Decide how much you want to deposit (between 200and2,000).

- Apply Online: Visit Firstcard’s website and fill out the application form.

- Submit Your Deposit: Once approved, you’ll need to submit your security deposit to activate your card.

- Receive Your Card: Your card will arrive in the mail within 7-10 business days.

Firstcard Secured Credit Builder Card App: How to Download and Use to Manage Your Account

The Firstcard Secured Credit Builder Card app is a powerful tool for anyone looking to manage their account easily and efficiently. With it, you can track your spending, pay bills, monitor your credit progress, and much more, all directly from your phone. Let’s teach you how to download the app and make the most of its features.

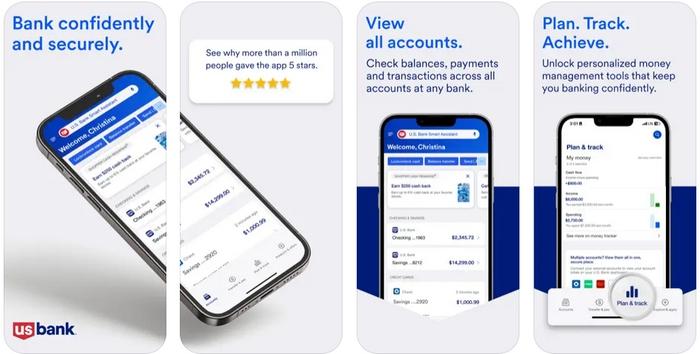

Key Features of the Firstcard App

The app is designed to simplify your financial life. Check out some of its most useful features:

- Spending Tracking: View all your transactions in real-time, organized by category.

- Bill Payments: Pay your bill directly through the app, no computer needed.

- Credit Monitoring: Track your credit progress and see how your actions are impacting your score.

- Custom Notifications: Receive alerts about due dates, suspicious transactions, and promotions.

- Financial Education Tools: Access tips and resources to learn more about managing your credit and finances.

- Customer Support: Chat with support directly through the app for any questions or issues.

How to Download the Firstcard App

Downloading the app is simple and fast. Follow the steps below based on your device:

For Android Devices:

- Open the Google Play Store on your phone.

- In the search bar, type “Firstcard Secured Credit Builder”.

- Locate the official Firstcard app (with the corresponding icon and name).

- Click “Install” and wait for the download to complete.

- After installation, open the app and log in with your Firstcard account credentials.

For iOS Devices (iPhone):

- Open the App Store on your iPhone.

- In the search bar, type “Firstcard Secured Credit Builder”.

- Find the official Firstcard app (corresponding icon and name).

- Tap “Download” and wait for the installation to finish.

- Open the app and enter your login and password to access your account.

Tips for Using the Firstcard Secured Credit Builder Card Effectively

To make the most of this card and boost your credit score, follow these tips:

- Pay On Time, Every Time: Payment history is the most significant factor in your credit score. Set up automatic payments to avoid missing due dates.

- Keep Your Balance Low: Aim to use less than 30% of your credit limit. For example, if your limit is 500,trytokeepyourbalancebelow150.

- Monitor Your Credit Score: Use free tools like Credit Karma or Firstcard’s app to track your progress.

- Avoid Closing the Account: Once you’ve built your credit, consider keeping the card open to maintain a longer credit history.

Fees and Costs to Know

While the Firstcard Secured Credit Builder Card is affordable, it’s essential to understand the fees involved:

- Annual Fee: $0 (no annual fee!).

- Interest Rate: Variable, depending on your credit profile.

- Late Payment Fee: Up to $40.

- Foreign Transaction Fee: 3% of the purchase amount.

Real-Life Example: How the Card Helped Sarah Rebuild Her Credit

Sarah had a credit score of 520 due to past financial mistakes. She applied for the Firstcard Secured Credit Builder Card with a $300 deposit. By using the card responsibly—keeping her balance low and paying on time—she saw her credit score increase to 650 within a year. Today, Sarah qualifies for unsecured credit cards and even got approved for a car loan!

Common Questions About the Firstcard Secured Credit Builder Card

1. Can I Upgrade to an Unsecured Card?

Yes! After demonstrating responsible use, you may be eligible to upgrade to an unsecured card and get your deposit refunded.

2. How Long Does It Take to Build Credit?

Most users see improvements within 6-12 months, but results vary based on your credit history and usage.

3. Is My Deposit Refundable?

Absolutely. When you close your account or upgrade to an unsecured card, your deposit is returned (minus any outstanding balances).

Is the Firstcard Secured Credit Builder Card Right for You?

If you’re looking for a no-fuss, affordable way to build or rebuild your credit, the Firstcard Secured Credit Builder Card is an excellent choice. With no annual fee, low deposit requirements, and credit-building tools, it’s designed to help you succeed.

Start Building Your Credit Today

The Firstcard Secured Credit Builder Card is more than just a credit card—it’s a tool to help you achieve financial stability. By using it responsibly, you can improve your credit score, unlock better financial opportunities, and take control of your future.

Ready to take the first step toward better credit? Apply for the Firstcard Secured Credit Builder Card today and start your journey to financial freedom! Click here to get started.