Wells Fargo Attune Card: Benefits, How It Works, and Is It Worth It?

Have you heard of the Wells Fargo Attune card? If you’re looking for a credit card that blends practical benefits with generous rewards, this might be the one for you.

Advertising

In this guide, we’ll dive deep into what makes this card special, how it works, its pros and cons, and whether it’s truly worth it for your lifestyle. Let’s get started!

What Is the Wells Fargo Attune Card?

Advertising

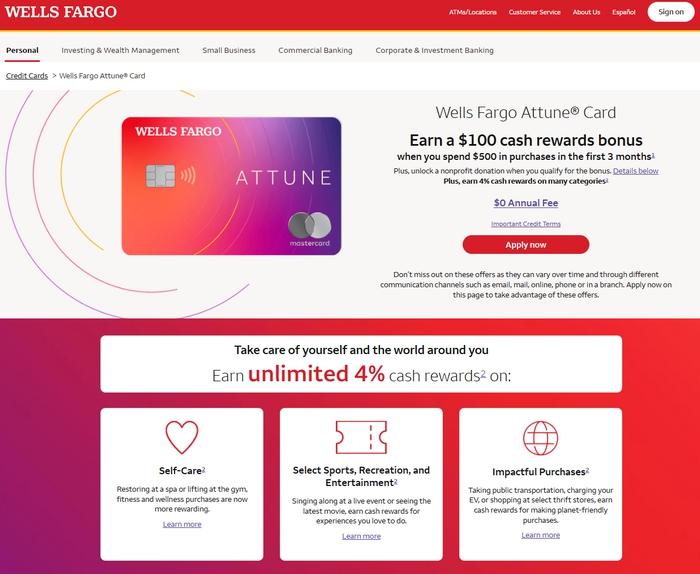

The Wells Fargo Attune is a credit card launched by Wells Fargo, one of the largest financial institutions in the United States. It’s designed for consumers seeking simplicity, cashback rewards, and benefits tailored to everyday spending. Unlike other cards, it focuses on common spending categories like health, wellness, entertainment, and social impact, offering attractive returns.

Advertising

Why does it stand out? Because it combines a robust rewards program with competitive fees and flexibility. But before you rush to apply, let’s break down how it works and what it offers.

Key Features of the Card

Here are the standout features of the Wells Fargo Attune:

- Generous Cashback: Earn 4% cashback on categories like gyms, cultural events, charity, and wellness, and 1% on all other purchases.

- No Annual Fee: That’s right, zero annual fees, perfect for those looking to save.

- Welcome Bonus: Earn a $100 cashback bonus after spending $500 in the first three months (subject to change, check terms).

- Promotional APR: 0% APR on purchases and balance transfers for 12 months, ideal for those needing financial breathing room.

- Extra Protections: Includes travel insurance, fraud protection, and emergency assistance benefits.

These features show that the Attune is geared toward those who value straightforward rewards. But how does it stack up against other cards? Let’s explore.

How Does the Cashback Program Work?

The big draw of the Wells Fargo Attune is its cashback. Unlike cards with complicated points systems, this one is simple: you spend, you earn cashback, and you can use it however you want. Let’s break down the reward categories:

4% Cashback Categories

The Attune shines in spending related to:

- Health and Wellness: Gyms, spas, yoga studios, and even medical appointments.

- Cultural Entertainment: Tickets for concerts, museums, theaters, and sporting events.

- Social Impact: Donations to nonprofits, charities, and environmental causes.

For example, if you spend $200 a month on a gym membership and $100 on concert tickets, you’d earn $12 in cashback just from those categories (4% of $300). Not bad, right?

1% Cashback on Everything Else

For all other purchases—groceries, gas, dining—you earn 1% cashback. While less exciting, it’s a solid return for a no-annual-fee card.

How to Redeem Cashback?

Flexibility is a strong suit. You can:

- Deposit cashback directly into your Wells Fargo account.

- Use it as a statement credit on your card.

- Redeem it for gift cards or purchases with select partners.

Pro tip: Save up your cashback for a few months and use it to pay off a big bill, like your year-end statement. That way, you’ll really feel the savings.

Benefits of the Wells Fargo Attune Card

Beyond cashback, the Attune offers perks that make a difference in daily life. Here are the top benefits:

1. No Annual Fee

Many cards with generous rewards come with hefty annual fees. The Attune eliminates that worry, making it accessible to everyone.

2. Promotional APR

The 0% APR for 12 months on purchases and balance transfers is perfect for financing a large purchase or transferring a balance from another card without paying interest. Just beware: after the promotional period, the standard APR ranges from 15.99% to 25.99%, depending on your credit.

3. Protections and Assistance

The card includes:

- Travel Insurance: Coverage for trip cancellations or interruptions.

- Fraud Protection: 24/7 monitoring for suspicious transactions.

- Travel Assistance: Support in emergencies, like lost documents.

4. Digital Wallet Compatibility

Use the Attune with Apple Pay, Google Pay, or Samsung Pay for fast, secure payments.

5. Financial Management Tools

Wells Fargo provides an intuitive app where you can track spending, check accumulated cashback, and pay your bill. This makes it easy to keep your finances organized.

How to Apply for the Wells Fargo Attune Card

The Wells Fargo Attune Card is a premium credit card designed to complement the Wells Fargo Atunne app, offering exclusive rewards, competitive rates, and seamless integration with your financial management tools.

Applying for the card is straightforward, whether you’re an existing Wells Fargo customer or new to the bank. Below is a step-by-step guide to help you apply for the Attune Card, along with eligibility requirements and tips to ensure a smooth application process.

Eligibility Requirements

To qualify for the Wells Fargo Attune Card, applicants typically need to meet the following criteria:

- Age: Be at least 18 years old.

- Credit Score: A good to excellent credit score (generally 670 or higher) is recommended for approval.

- Income: Provide proof of stable income to demonstrate the ability to repay credit.

- Residency: Be a U.S. resident with a valid Social Security Number or Individual Taxpayer Identification Number.

- Wells Fargo Account (Optional): While not mandatory, having an existing Wells Fargo account (checking, savings, or Atunne app user) may streamline the process.

Steps to Apply

Visit the Official Wells Fargo Website or Atunne App

- Navigate to the Wells Fargo website (www.wellsfargo.com) or open the Atunne app.

- Locate the “Credit Cards” section and select the Attune Card from the available options.

Review Card Details:

- Familiarize yourself with the card’s benefits, such as cashback rewards, travel perks, or low APR offers, as well as any annual fees or terms.

- Ensure the card aligns with your financial needs and spending habits.

Complete the Online Application:

- Click “Apply Now” to access the secure application form.

- Provide personal information, including:

- Full name, address, and contact details.

- Social Security Number or ITIN.

- Employment status and annual income.

- Housing payment details (rent or mortgage).

- If you’re a Wells Fargo customer, log in to pre-fill some information.

Submit and Review:

- Double-check your application for accuracy to avoid delays.

- Submit the application. Wells Fargo will perform a credit check, which may result in a hard inquiry on your credit report.

Receive a Decision:

- Instant decisions are often provided online. If additional review is needed, Wells Fargo will notify you within 7-10 business days.

- If approved, your Attune Card will be mailed to your address within 5-7 business days.

Activate Your Card:

Once received, activate your card via the Atunne app, online at the Wells Fargo website, or by calling the customer service number provided with the card.

Link the card to your Atunne app for seamless tracking of transactions and rewards.

Who Is the Wells Fargo Attune Card Ideal For?

Not every card is perfect for everyone. The Attune is a great fit if you:

- Spend heavily on health, wellness, or entertainment (gyms, concerts, etc.).

- Want a no-annual-fee card with solid rewards.

- Need a no-interest period for purchases or balance transfers.

- Value simplicity and flexibility in redeeming rewards.

On the flip side, if you travel internationally often, you might prefer a card with no foreign transaction fees (the Attune charges 3%). Or, if your spending focuses on travel or dining, other cards might offer higher cashback in those areas.

How to Apply for the Wells Fargo Attune Card?

Interested? Applying for the Attune is straightforward but requires a few steps:

- Check Your Credit Score: Wells Fargo typically requires a good credit score (above 670). Use tools like Credit Karma to check yours before applying.

- Visit the Wells Fargo Website: Go to the official Attune card page and click “Apply Now.”

- Fill Out the Form: Provide personal details like income, address, and Social Security number.

- Await Approval: You may get an instant response or wait a few days, depending on the review.

Tip: Avoid applying for multiple cards at once, as this can negatively impact your credit score.

Pros and Cons of the Wells Fargo Attune Card

To help you decide, here’s a quick rundown of the strengths and weaknesses:

Pros

- 4% cashback in specific categories like wellness and entertainment.

- No annual fee, great for saving money.

- $100 welcome bonus (subject to terms).

- 0% APR for 12 months on purchases and transfers.

- Flexible and easy cashback redemption.

Cons

- 3% foreign transaction fee, not ideal for international travel.

- 1% cashback on general purchases is less competitive than some cards.

- Requires a good credit score for approval.

Comparison with Other Cards

How does the Attune fare against the competition? Let’s compare it to two popular cards:

- Chase Freedom Unlimited: Offers 1.5% cashback on all purchases and 5% on rotating categories, but charges foreign transaction fees and has an annual fee after the first year.

- Citi Double Cash: Provides 2% cashback (1% at purchase + 1% when you pay the bill), but lacks a welcome bonus or high cashback categories like the Attune.

The Attune wins in simplicity and its 4% categories but may lag if you want higher general cashback.

Wells Fargo Atunne App

The Wells Fargo Atunne is an innovative application developed by Wells Fargo, designed to provide a personalized and intuitive banking experience for its customers. With a focus on simplicity, security, and functionality, Atunne integrates modern financial tools to streamline account management, investments, and daily transactions. Below, we explore the main features and benefits of the app:

Key Features

- Integrated Account Management: Atunne allows users to view balances, transactions, and histories of all their Wells Fargo accounts (checking, savings, credit cards) in a single, user-friendly interface.

- Personalized Financial Planning: Powered by artificial intelligence, the app provides financial insights, such as budget suggestions, spending forecasts, and savings goals tailored to the user’s profile.

- Simplified Payments and Transfers: Perform instant transfers between Wells Fargo accounts or to other banks, pay bills, and send money via Zelle directly through the app.

- Advanced Security: Atunne employs biometric authentication (fingerprint and facial recognition), end-to-end encryption, and real-time alerts to protect user data and transactions.

- Investments and Advisory: Access investment tools, monitor portfolios, and receive personalized recommendations with integration to Wells Fargo’s wealth management services.

User Benefits

- Intuitive Experience: The clean interface and user-centric design make navigation easy, even for those not tech-savvy.

- 24/7 Accessibility: Manage your finances anytime, anywhere, with support for iOS and Android devices.

- Financial Sustainability: Planning tools help users make informed decisions, promoting long-term financial health.

- Integrated Support: The app offers live chat with Wells Fargo representatives and access to educational financial resources.

How to Download and Use

The Wells Fargo Atunne is available for free on the App Store and Google Play. To get started, download the app, log in with your Wells Fargo credentials (or create an account if you’re not yet a customer), and set up your preferences. The app is regularly updated to include new features and improvements based on user feedback.

Is the Wells Fargo Attune Card Worth It?

The answer depends on your lifestyle. If you regularly spend on gyms, cultural events, or donations, the 4% cashback can add up significantly. The lack of an annual fee and the promotional APR make it even more appealing, especially for those needing financial flexibility.

For example, say you spend $500 a month in 4% categories and $1,000 on other purchases. In a year, that earns:

- $500 x 4% x 12 = $240 cashback in the main categories.

- $1,000 x 1% x 12 = $120 cashback on other purchases.

- Total: $360 cashback per year, with no annual fee.

Pretty solid for a no-fee card, right?

Tips to Maximize the Card

Want to get the most out of the Attune? Follow these tips:

- Focus Spending on 4% Categories: Plan your purchases to maximize cashback on gyms, concerts, and charity.

- Pay Your Bill on Time: Avoid high interest rates after the promotional period.

- Claim the Welcome Bonus: Spend the required $500 in the first three months to secure the $100 bonus.

- Track with the App: Monitor spending and cashback to plan redemptions.

- Avoid International Transactions: Use another card for overseas purchases to save on the 3% fee.

Is the Wells Fargo Attune Card Right for You?

The Wells Fargo Attune card is a strong choice for those seeking hassle-free rewards, especially if you spend on health, entertainment, or social causes. With generous cashback, no annual fee, and a promotional APR, it delivers real value for the savvy consumer. However, if you travel often or want higher cashback in other categories, you might want to explore other options.

Ready to save with cashback and enjoy exclusive perks? Click now to learn more about the Wells Fargo Attune card and apply on the official Wells Fargo website! Don’t miss your chance to turn spending into rewards.