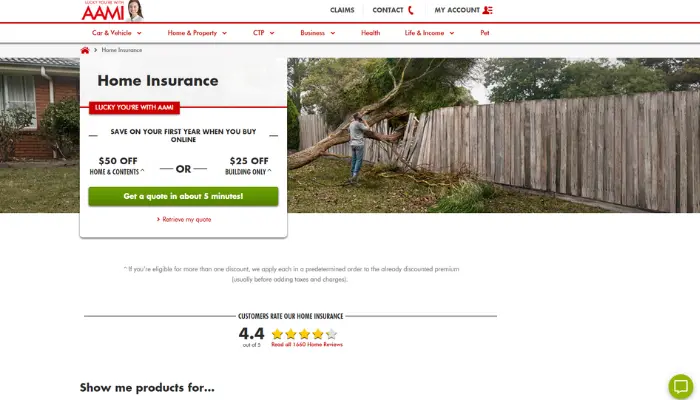

AAMI Home Insurance Review: Is It Right for Your Home?

Protecting your home is one of the most significant responsibilities you can take on. After all, it’s where you build memories and invest your life.

AAMI Home Insurance offers a range of coverages that ensure your home is protected from unforeseen events. In this article, we’ll explore the main coverages and benefits that make AAMI home insurance a great choice for homeowners.

Complete Replacement Cover

The Complete Replacement Cover is one of the most attractive features of AAMI Home Insurance. It ensures that in the event of major damage or total loss, your home will be rebuilt or repaired, regardless of the cost.

This means that even if the rebuilding costs exceed the initially insured amount, you’ll be protected from unexpected financial surprises.

Why choose Complete Replacement Cover?

- Total coverage: Ensures complete home repair without being limited by the insured value.

- Peace of mind: Avoids concerns about rising material and construction costs.

- Inflation protection: If prices increase over time, your home will still be fully rebuilt.

This type of coverage is ideal for those seeking robust and secure insurance, guaranteeing that your home is protected no matter how rebuilding costs fluctuate.

Accidental Damage and Optional Add-ons

Life is full of unexpected mishaps—whether it’s a broken window from a stray football or a heavy object that accidentally falls and causes damage.

AAMI Home Insurance provides comprehensive coverage for such unforeseen events, giving you peace of mind in case accidents happen.

Beyond the standard policy, you can further enhance your protection by choosing from a range of optional add-ons, allowing you to customize your insurance to fit your unique needs.

Optional coverages you can add:

- Accidental damage: Protects against accidental breakage, like glass and mirrors.

- AAMI Home Assist: A service that provides immediate support in case of home emergencies, such as broken pipes or damaged doors.

- Excess-free glass cover: Replaces broken glass without the need to pay the excess.

This flexibility allows you to tailor the insurance to your needs, ensuring you are covered for any unforeseen situation.

Temporary Accommodation

In cases of disasters where your home becomes uninhabitable, AAMI Home Insurance covers the costs of temporary accommodation. This means you won’t have to worry about finding a place to stay while your home is being repaired.

Benefits of temporary accommodation:

- Covers expenses for hotel stays or temporary rentals.

- Provides financial peace of mind during the repair period.

- Applicable to situations like fires, storms, or other covered events.

This benefit is essential for anyone who wants to ensure they have a place to stay in case of disasters, reducing stress during the home repair process.

Motor Burnout Coverage

One of the standout features of AAMI Home Insurance is its Motor Burnout Coverage, designed to protect the motors of essential appliances and fixtures in your home.

This coverage ensures that you won’t be left facing expensive repairs or replacements if the motor of a key household device fails.

How does this coverage work?

- Protects motors for fixed devices in the house.

- Includes repairs or replacement in case of electrical failure.

- Applicable for motors up to 7 years old.

If you’ve ever experienced problems with the motor of an essential home appliance, you’ll know how helpful this coverage can be. It reduces repair costs and ensures these devices will be back up and running soon.

Coverage for Floods and Storms

Floods and storms can cause significant damage to homes, especially in regions prone to extreme weather events.

AAMI Home Insurance recognizes the importance of protecting your home against these unpredictable forces of nature, offering comprehensive coverage that ensures both structural integrity and peace of mind.

AAMI’s Flood and Storm Coverage extends beyond just the basic protection, giving homeowners a robust shield against various types of weather-related damage.

What does this coverage include?

- Flood and storm damage: Covers water and wind damage caused by events such as heavy rainfall, hailstorms, and severe windstorms.

- Cyclone coverage: If you live in an area prone to cyclones, AAMI ensures that any damage caused by these powerful storms is covered.

- Storm surges: Rising sea levels during storms can lead to destructive flooding. AAMI provides coverage for damage caused by storm surges, ensuring that you’re protected even in coastal regions.

Why is this coverage essential? For residents in high-risk areas, flood and storm coverage is a critical safety net.

It not only protects your home from structural damage but also covers the costs of repair and replacement, preventing financial strain in the aftermath of a natural disaster.

AAMI goes the extra mile by offering tailored coverage that accounts for regional risks, giving you the flexibility and confidence to handle whatever nature throws your way.

With this type of insurance, you can rest easy knowing that your home and finances are protected against the unpredictable power of extreme weather events.

Discounts for Combining Home and Contents Insurance

AAMI offers an attractive discount for those who combine home insurance with contents insurance. This means that, besides protecting the structure of your house, you can also ensure the safety of valuable items within, such as furniture, electronics, and appliances.

How does the discount work?

- When you combine both policies, you receive a 10% discount.

- Protects both the property and valuable items inside.

- Ideal for those looking for comprehensive, integrated protection.

This combination is an excellent way to save money while ensuring that both your home and belongings are fully protected.

Claims Process and 24/7 Support

AAMI is known for its simplified claims process, which can be done online or through mobile apps. Additionally, the company provides 24/7 support, ensuring that you can start the claims process at any time of day.

Step-by-step guide to filing a claim:

- Access the AAMI website or mobile app.

- Have your contract details and event information (photos, documents, police reports, if applicable) ready.

- Fill out the online form, which takes around 10 minutes.

- An AAMI specialist will contact you to schedule an inspection and begin the repair or replacement process.

Benefits of the online claims process:

- Speed: Claims can be submitted in minutes.

- Convenience: Can be done from anywhere, at any time.

- Transparency: Track your claim status and update information as needed.

This streamlined process and 24/7 support make the experience easier, reducing the stress of dealing with difficult situations.

AAMI Home Insurance offers a complete range of coverages and benefits that ensure full protection for your home and belongings.

From complete replacement coverage to natural disaster protection, AAMI insurance is a solid choice for homeowners looking for security and peace of mind.

Additionally, the flexibility of optional add-ons and the simplified claims process make AAMI Home Insurance an excellent option for those wanting the best protection for their home.