How AIG Life Insurance Riders Can Enhance Your Coverage

Choosing life insurance is a major decision, and you’re likely here because you want to protect your loved ones in case something happens to you.

Advertising

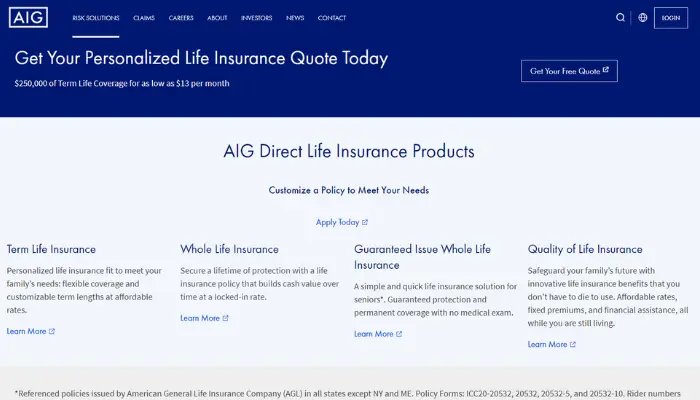

AIG Life Insurance offers a variety of life insurance plans designed to meet different needs, and this guide is made to help you understand what AIG can offer.

Advertising

We’ll talk about coverage types, additional benefits, and what to expect during the application and claim process, all in a clear and accessible way.

AIG Life Insurance Coverage

When it comes to life insurance, finding the right fit for your personal and financial situation is key.

Advertising

AIG understands this, offering a comprehensive range of life insurance options designed to cater to a variety of needs, from temporary coverage to lifelong protection.

Whether you’re looking to safeguard your family during critical years or want peace of mind with a policy that builds value over time, AIG has you covered. Below are the main types of coverage you can explore:

- Term Life Insurance: This type of policy provides coverage for a specific period, such as 10, 20, or 30 years. It is ideal for people who want financial protection for a set time, like the period required to pay off a mortgage or raise children.

- Whole Life Insurance: Offers lifetime coverage and includes a cash value component that grows over time. This is an interesting option if you want to ensure your family is always protected, no matter when something might happen.

- Universal Life Insurance: A type of permanent insurance that offers more flexibility in terms of premiums and benefits, adjusting the coverage as your needs change throughout life.

- Child Life Insurance: AIG also offers life insurance specifically designed for children, ensuring they have protection from an early age.

Each of these policies comes with specific benefits that you can adjust according to your needs. Let’s talk more about these customizations next.

Additional Benefits (Riders) of AIG Life Insurance

One of the key advantages of AIG life insurance plans is the flexibility to enhance your coverage through riders.

These are optional add-ons that allow you to tailor your policy to meet your unique needs and provide additional protection in specific situations.

By adding riders, you can ensure that your life insurance offers more comprehensive support for you and your family during life’s unexpected challenges.

Below are some popular riders available with AIG life insurance:

- Disability Rider: If you become permanently unable to work, this rider allows you to continue receiving benefits without having to pay the insurance premium.

- Critical Illness Rider: If you are diagnosed with a severe condition, such as cancer or a heart attack, this rider allows you to receive a portion of the policy’s benefit in advance to help with medical costs.

- Long-Term Care Rider: Covers expenses related to long-term care, such as nursing home care or home health care.

- Accidental Death Rider: Provides an additional benefit in the event of death caused by an accident.

These riders are an excellent way to customize your life insurance plan to ensure you have the coverage that matters most to you.

AIG Life Insurance Application Process

Once you’ve determined that AIG life insurance is the right fit for you, understanding the application process is your next step.

While applying for life insurance can seem daunting, AIG strives to make it as smooth and straightforward as possible.

By being prepared and following a clear set of steps, you can simplify the process and get the coverage you need with minimal hassle.

Below is a step-by-step guide to help you through the journey:

- Choose a policy: The first step is to select the type of policy that best meets your needs. This depends on your financial goals and the people you want to protect.

- Complete the application form: AIG will require personal and financial information to assess your eligibility. Have documents like your ID, tax number, and proof of income ready.

- Medical exam (depending on the policy): Some policies require a medical exam to determine your current health conditions.

- Insurer review: After submitting your application and medical results, AIG will review the documents and determine the premium amount based on your risks and the type of policy selected.

- Acceptance and issuance of the policy: If everything is in order, you will receive your approved policy and can start paying the premiums according to the established schedule.

The process is generally simple, but having all the necessary information and documents ready can speed things up significantly.

AIG Life Insurance Prices and Premiums

When we talk about prices and premiums, it’s important to understand that the cost of life insurance depends on several factors. Here are the main elements that influence the amount you’ll pay monthly or annually:

- Age: The younger you are, the lower your premium will be, as the risks to the insurer are lower.

- Health: People in good health can qualify for lower premiums, especially if they don’t have pre-existing medical conditions.

- Coverage chosen: Policies with higher coverage amounts will naturally have higher premiums.

- Type of policy: Term life insurance tends to be cheaper than permanent insurance.

A valuable tip is to use the premium calculation tools available on AIG’s website, which can help you find the exact amount you’ll pay based on your personal conditions.

How to Make an AIG Life Insurance Claim

If you find yourself in a situation where you need to make a life insurance claim, knowing how the process works can bring peace of mind. Here’s a simple step-by-step guide to help you:

- Contact AIG: Get in touch with AIG’s customer service to inform them of the policyholder’s death and start the claim process.

- Required documentation: AIG will request documents such as the death certificate and policy information. Have these ready to avoid delays.

- Submit the documentation: Send the requested documents to AIG through the indicated channels (online or by mail).

- Review and payment: The insurer will review the documentation and, if everything is in order, the payment will be made to the beneficiaries designated in the policy.

This process may seem complicated, but AIG provides support along the way to ensure everything is done correctly.

Customer Reviews and Feedback on AIG Life Insurance

Many customers highlight the flexibility and variety of options that AIG offers when it comes to life insurance. Here are some frequent points found in feedback:

- Customizable options: Most customers appreciate the ability to add riders and customize their coverage.

- Easy application process: Users mention that the online application process is straightforward and simple.

- Customer support: AIG is often praised for its efficient and attentive customer support, especially during the claims process.

However, some customers mention that premiums can be higher compared to other insurers, particularly with permanent life insurance policies.

AIG Life Insurance Eligibility and Requirements

The eligibility requirements for an AIG life insurance policy vary depending on the type of coverage chosen. Here are some factors that influence eligibility:

- Age: AIG generally offers policies to individuals between the ages of 18 and 75, though ranges may vary depending on the product.

- Health condition: Some policies require medical exams or health questionnaires. However, there are no-medical-exam options, though these may come with higher premiums.

- Financial history: In some cases, AIG may request financial information to assess your ability to pay premiums over the long term.

Be sure to review the specific criteria for each policy when considering your life insurance options.

AIG Life Insurance is a reliable solution for those looking to secure financial protection for their loved ones. With a variety of customizable options and benefits, you can find a policy that perfectly fits your needs.

Additionally, the application and claims process is simple, making the experience smoother and more trustworthy.

If you’re thinking about investing in a life insurance policy, AIG is a solid choice, with decades of experience and a reputation that reflects its commitment to customer satisfaction.