Allstate Motorcycle Insurance: Safety and Confidence on Every Rid

If you’re a motorcyclist looking for reliable coverage, Allstate Motorcycle Insurance might be the ideal option for you.

In this article, we will explore various coverage options, additional benefits, available discounts, claims process, seasonal coverage, and the online quote process.

Let’s dive into the details so you can make an informed decision and ensure your motorcycle is well protected.

Coverage Options

When it comes to motorcycle insurance, it is essential to choose coverage that meets your specific needs. Allstate offers a diverse range of coverage options to ensure you are protected in any situation.

- Liability Coverage: This coverage is mandatory and protects against bodily injury and property damage that you may cause to others in an accident where you are at fault.

- Collision Coverage: Covers damage to your motorcycle resulting from a collision with another vehicle or object.

- Comprehensive Coverage: Protects against damage to your motorcycle that is not the result of a collision, such as theft, fire, or natural disasters.

- Customized Parts Coverage: Allows you to insure customized parts and accessories of your motorcycle in increments of $1,000.

- Uninsured/Underinsured Motorist Coverage: Protects you against damage caused by drivers who do not have insurance or whose coverage is insufficient.

These coverage options can be combined to create a personalized policy that best meets your needs.

Additional Benefits

In addition to basic coverage options, Allstate Motorcycle Insurance offers a range of additional benefits that can provide extra protection and peace of mind.

- Roadside Assistance: Includes towing services, tire changes, fuel delivery, and other emergency services on the road.

- Accessories and Equipment Coverage: Covers additional accessories and equipment, such as helmets, jackets, and other safety gear.

- Rental Reimbursement: If your motorcycle is being repaired after an accident, Allstate can cover the cost of renting a replacement motorcycle.

- Full Replacement Cost Coverage: Ensures you receive the full replacement value of your motorcycle in case of a total loss, without depreciation.

These benefits can be extremely valuable in case of an accident or other unexpected events, providing an extra layer of security and support.

Available Discounts

Saving on motorcycle insurance is always a plus, and Allstate offers several discounts to help reduce your policy costs.

- Multi-Policy Discount: If you have other insurance policies with Allstate, such as auto or home insurance, you may be eligible for a discount.

- Responsible Driver Discount: If you have a clean driving record, without accidents or violations, you may qualify for a discount.

- Club or Association Member Discount: Members of certain motorcycle clubs or associations may be eligible for additional discounts.

- Training Course Discount: Completing a motorcycle safety training course can result in a discount on your policy.

Taking advantage of these discounts can help make your motorcycle insurance more affordable while maintaining the same quality of coverage.

Claims Process

Allstate’s claims process is designed to be simple and efficient, ensuring you receive the necessary support quickly.

- Immediate Reporting: In case of an accident, report the claim to Allstate as soon as possible, through the app, website, or by phone.

- Damage Assessment: A claims adjuster will assess the damage to your motorcycle and determine the repair or replacement value.

- Repairs: Allstate works with a network of reliable repair shops to ensure your motorcycle is fixed quickly and with quality.

- Reimbursement: Depending on your coverage, you will be reimbursed for repair costs or receive the replacement value of your motorcycle.

This step-by-step process ensures you are well taken care of and that your motorcycle is back on the road as soon as possible.

Seasonal Coverage

For motorcyclists who do not use their motorcycles year-round, Allstate offers seasonal coverage options that can save money during inactive months.

- Temporary Coverage Suspension: Allows you to temporarily suspend certain coverages during months when the motorcycle is not used, reducing the premium.

- Active Coverage for Specific Risks: Even during suspension, you can maintain coverage against theft and other specific risks.

This flexibility is ideal for motorcyclists who live in regions with harsh winters or who simply do not use their motorcycle during certain parts of the year.

Online Quote Process

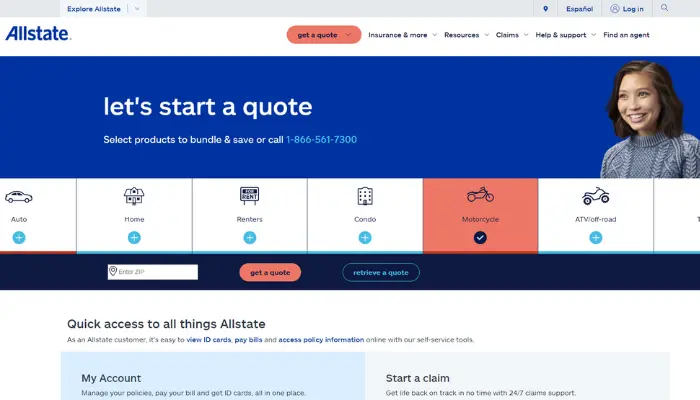

Getting an online quote for Allstate Motorcycle Insurance is an easy and convenient process. Here is a step-by-step guide to help you get started:

- Visit the Allstate Website: Go to Allstate’s motorcycle insurance page.

- Enter Your Information: Provide details about your motorcycle, including make, model, year, and any customization.

- Driver Details: Enter information about your driving history, including any recent infractions or accidents.

- Choose Coverage Options: Select the coverage options you want to include in your policy.

- Review the Quote: Receive the quote based on the information provided and review the details to ensure everything is correct.

- Adjust if Necessary: Make adjustments to coverages or add applicable discounts to optimize your policy.

- Finalize and Purchase: If you are satisfied with the quote, finalize the purchase online or contact an agent for additional assistance.

Allstate Motorcycle Insurance offers a solid mix of coverage options, additional benefits, attractive discounts, and an efficient claims process.

Whether you are an experienced rider or just starting out on the road, Allstate can adapt to your specific needs, offering various resources and flexibility to ensure your motorcycle is well taken care of.

Take advantage of seasonal coverage options and the easy online quote process to tailor the policy to your needs. With Allstate, you can have peace of mind in all situations—whatever happens, you will be well covered.