Citi Simplicity Credit Card: Benefits, Fees and How to Apply

The Citi Simplicity credit card is a popular option among consumers in the United States who seek simplicity and savings in their finances. Known for its consumer-friendly policies, Citi Simplicity stands out for its lack of annual fees and late fees, as well as offering a long 0% introductory APR period on balance transfers.

Advertising

This card is ideal for those who want to consolidate debt or make large purchases without worrying about immediate interest. In this article, we’ll explore in detail the benefits and features of the Citi Simplicity Credit Card, including its fees, balance transfer offers, and credit requirements. We’ll also compare Citi Simplicity to other popular credit card options, helping you make an informed decision about whether this is the right card for your financial needs.

How to Apply for the Citi Simplicity Credit Card

Advertising

Applying for the Citi Simplicity Credit Card is a simple and straightforward process. Here are the steps to apply:

Advertising

Access the Citi Website

Go to the official Citibank website and navigate to the credit cards section. Find the Citi Simplicity Credit Card page.

Fill Out the Online Application

Click the button to apply now. You will be directed to the online application form. Be prepared to provide the following information:

- Full name

- Residential address

- Date of birth

- Social Security Number (SSN)

- Employment and income information

- Contact information, such as phone number and email

Review the Terms and Conditions

Read the card’s terms and conditions carefully, including interest rates, fees, and policies. Make sure you understand all the details before proceeding.

Submit the Application

After filling out all the necessary information and reviewing the terms, submit your online application. Citibank will process your application and may request additional information if necessary.

Wait for Approval

The approval process can take a few minutes to a few days. During this time, Citibank will evaluate your credit score and other information to determine your eligibility.

Receive Your Card

If approved, you will receive your Citi Simplicity Credit Card by mail within 7 to 10 business days. Along with the card, you will receive instructions on how to activate it.

Activate the Card

Follow the provided instructions to activate your card, which can be done online or by phone. Once activated, you can start using your card immediately.

Set Up Online Account

It is recommended to set up an online account on the Citibank website to manage your transactions, view balances, and make payments.

Following these steps will ensure that your Citi Simplicity Credit Card application is processed efficiently and quickly, allowing you to start enjoying the card’s benefits as soon as possible.

Who Can Apply for the Citi Simplicity Card

The Citi Simplicity Credit Card is an attractive option for many consumers in the United States, but there are some basic requirements that must be met to qualify. Here are the main criteria for applying for the card:

- Minimum age: The applicant must be at least 18 years old. In some states, the minimum age may be 19.

- Residency: The card is available only to residents of the United States. A permanent residential address in the US is required to qualify.

- Credit history: The Citi Simplicity Credit Card is aimed at individuals with good to excellent credit history. Generally, a credit score above 670 increases the chances of approval. However, other factors such as payment history, income, and level of debt are also considered.

- Stable income: Applicants must have a stable and verifiable source of income. This can include employment, self-employment income, or other regular sources of income.

- Personal information: During the application process, you will need to provide personal information, including full name, address, date of birth, Social Security Number (SSN), and contact information.

- Identity verification: Citi may request additional documents to verify the applicant’s identity and the accuracy of the information provided in the application.

These requirements help ensure that applicants have the ability to manage a credit limit and make timely payments.

Benefits of Citi Simplicity Credit Card

The Citi Simplicity Credit Card offers a series of benefits that make it an attractive choice for many consumers in the United States. Here are the main highlights:

- No late fees and annual fees: You will never be charged for late payments or for keeping the card active, providing simplicity and savings in your daily finances.

- Long 0% introductory APR period on balance transfers: It can last up to 21 months, allowing you to consolidate your existing debts without accumulating additional interest, making debt management and payment easier.

Additionally, the Citi Simplicity offers other important benefits:

- Fraud protection: Keeping your transactions safe and secure.

- 24/7 customer service: Available at any time to assist with your needs and inquiries.

- Access to online account management tools: Making it easy to monitor and control your finances.

These features make Citi Simplicity a robust and reliable option for those looking for a credit card focused on savings and convenience.

Do you have an annual fee?

The Citi Simplicity card stands out for its no annual fee feature, allowing you to enjoy all the card’s benefits without worrying about additional yearly costs.

Interest Rates

The Citi Simplicity card offers an interest rate structure that can be quite attractive, especially during the introductory period. Here are the details of the main interest rates associated with this card:

- 0% introductory APR on balance transfers: Up to 21 months from the date of the first balance transfer, allowing cardholders to consolidate their debts without accruing interest during this period.

- 0% introductory APR on purchases: Usually offered for a limited period after account opening, providing an opportunity to make large purchases without interest initially.

- Variable APR for purchases: After the introductory period ends, the variable interest rate for purchases can range between 18.99% and 29.74%, depending on your credit evaluation.

- Variable APR for balance transfers: After the introductory period, the variable interest rate for balance transfers is the same as the APR for purchases, ranging between 18.99% and 29.74%.

- Variable APR for cash advances: Generally higher, around 29.99%, applicable from the date of the cash advance.

- Penalty APR: If you make a late payment, the penalty APR can be applied, reaching up to 29.99%.

These interest rates highlight the importance of taking advantage of the introductory period for balance transfers and purchases, as well as maintaining a good payment history to avoid higher interest rates in the future.

What type of coverage does the card offer?

The Citi Simplicity card is issued on the Mastercard network, providing cardholders with extensive coverage and a variety of benefits.

Flag

Mastercard.

What is the minimum income required?

The Citi Simplicity credit card does not specify a minimum income requirement publicly. However, a steady income is necessary to demonstrate the ability to repay the credit card debt. While the card is primarily aimed at individuals with a good to excellent credit score, Citi evaluates each application individually, considering various factors such as income, debt-to-income ratio, and credit history. Having a higher income can enhance your chances of approval, but the exact minimum income threshold is not explicitly stated by Citi.

How to Check Your Citi Simplicity Card Statement

Checking your Citi Simplicity card statement is easy and can be done through several convenient methods. Here’s a step-by-step guide to help you manage your account and stay on top of your finances:

1. Online Banking

- Log In: Visit the Citi website and log in to your online banking account using your username and password.

- Access Statements: Once logged in, navigate to the “Account Details” section. Select your Citi Simplicity card account and click on “Statements” to view your current and past statements.

- Download or Print: You can download or print your statements for your records or review them online.

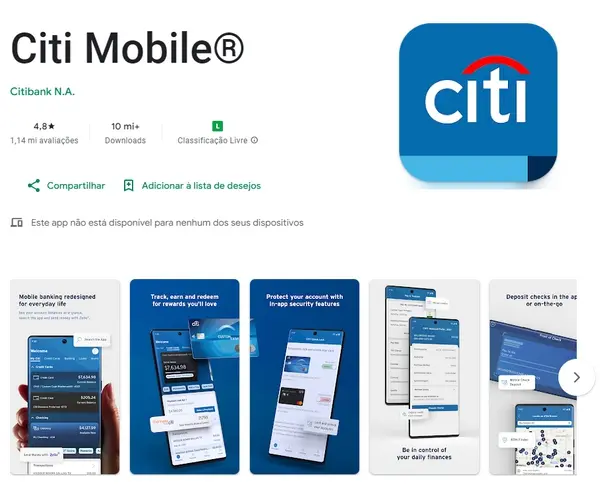

2. Citi Mobile App

- Download the App: If you haven’t already, download the Citi Mobile app from the App Store (iOS) or Google Play (Android).

- Log In: Open the app and log in with your Citi online banking credentials.

- View Statements: Select your Citi Simplicity card account from the dashboard. Tap on “Statements” to view your statements.

- Convenience: The app allows you to check your statement anytime, anywhere, and set up alerts for new statements.

3. Email Notifications

- Sign Up for E-Statements: Opt for electronic statements by signing up through your online banking account or mobile app. You will receive an email notification each time a new statement is available.

- Check Email: Open the email notification and click the provided link to access your statement directly.

4. Phone Banking

- Call Customer Service: Dial the Citi customer service number at 1-800-950-5114.

- Follow Prompts: Follow the automated prompts to navigate to the credit card services section.

- Request Statement Information: You can request information about your current statement balance, recent transactions, and payment due dates.

5. Paper Statements

- Receive by Mail: If you prefer, you can continue to receive paper statements by mail each month.

- Review Statements: When you receive your statement, review the transactions, balance, and payment due date. If you have any questions or notice discrepancies, contact Citi customer service.

How to Activate Your Citi Simplicity Card

Activating your Citi Simplicity card is a quick and straightforward process that can be completed through various methods. Here’s how to do it:

Online Activation

- Log In: Visit the Citi website and log in to your account using your username and password.

- Navigate to Activation: Once logged in, go to the “Services” or “Account Management” section and find the option to activate your card.

- Enter Details: Follow the prompts to enter your card information, such as the card number, expiration date, and CVV code.

- Confirm Activation: Submit the information to complete the activation process. You will receive a confirmation message once your card is activated.

Mobile App Activation

- Download the App: If you haven’t already, download the Citi Mobile app from the App Store (iOS) or Google Play (Android).

- Log In: Open the app and log in using your Citi online banking credentials.

- Activate Card: Select your Citi Simplicity card account from the dashboard. Look for the activation option and follow the on-screen instructions to enter your card details.

- Complete Activation: Submit the information and receive a confirmation that your card has been activated.

Phone Activation

- Call the Activation Number: Dial the number provided on the sticker attached to your new card. This number is typically toll-free.

- Follow Prompts: Follow the automated prompts to enter your card number, the last four digits of your Social Security number, and any other required information.

- Confirm Activation: Once you have entered all the necessary details, the system will confirm that your card is activated.

Citi Simplicity Card App

The Citibank mobile app offers Citi Simplicity Credit Card holders a convenient and efficient way to manage their accounts directly from their smartphones or tablets.

With a user-friendly interface and various functionalities, the app is an indispensable tool for those seeking convenience in financial management. Here are some of the main features and benefits of the app:

Account Management

Access detailed information about your account, including current balances, recent transactions, and credit limits. View your payment history and billing details with ease.

Payments and Transfers

Make bill payments directly through the app. You can set up automatic payments to ensure you never miss a due date and transfer funds between your Citi accounts.

Alerts and Notifications

Set up personalized alerts to monitor your account activities. Receive notifications about transactions, low balances, payment due dates, and potential fraud.

Credit Score Monitoring

Track your credit score directly in the app. This feature helps you stay informed about your financial health and make more informed credit decisions.

Advanced Security

The app uses top-notch security technology, including biometric authentication (fingerprint or facial recognition), to protect your personal and financial information.

Offers and Rewards

Access special offers and exclusive rewards for Citi cardholders. Explore personalized promotions and savings opportunities directly in the app.

Customer Support

Easily contact customer support through the app. Use live chat, send secure messages, or find useful phone numbers for quick assistance.

Easy Navigation

The app’s intuitive interface allows for easy and quick navigation, ensuring that all functionalities are just a few taps away.

The Citi Simplicity card app simplifies financial management, offering a centralized platform to control all your account needs. With it, you can stay updated and in control of your finances, no matter where you are.

Customer Service

The Citi Simplicity Credit Card offers a comprehensive range of customer service options to ensure cardholders can obtain assistance and resolve their queries or issues quickly and efficiently. Here are some of the main features of Citi Simplicity’s customer service:

24/7 Support

Customer service is available 24 hours a day, 7 days a week. This means that no matter the time, you can get help for any issue related to your credit card.

Multiple Communication Channels

You can contact customer service by phone, live chat on the Citi website, email, or secure messages through the Citi mobile app. This variety of channels ensures you can choose the most convenient method for your needs.

Automated Service

For quick inquiries, Citi offers an automated system that can provide information about balances, recent transactions, payments, and more without the need to speak to a live representative.

Fraud Assistance

Citi takes security very seriously and offers immediate support in cases of suspected fraud. If you notice any suspicious activity on your account, you can contact customer service to block the card and resolve the situation.

Dispute Resolution

If you encounter incorrect or disputed charges on your statement, customer service is prepared to help resolve disputes, investigate charges, and take necessary actions to correct any errors.

Financial Advice

In addition to resolving specific card issues, Citi representatives can offer guidance on how to manage your credit more effectively, including tips on improving your credit score and managing debts.

Access to Online Resources

The Citi website and mobile app offer a wide range of self-service resources, including FAQs, tutorials, and guides that can help resolve common questions without the need for direct support contact.

Personalized Notifications and Alerts

You can set up personalized notifications and alerts to monitor your account activities, payment due dates, and more, ensuring you are always informed about the status of your account.

Citi Simplicity’s customer service is designed to be accessible, efficient, and helpful, providing a positive experience and reliable support for all cardholders.