Comprehensive Frank Health Insurance Plans for All Your Needs

Navigating the world of health insurance can be daunting, but Frank Health Insurance stands out as a reliable and comprehensive option.

Whether you are seeking private hospital coverage, savings on claims during the COVID-19 pandemic, understanding waiting periods, or tailored plans for foreign visitors, Frank Health Insurance has got you covered.

This article delves into the various aspects of Frank Health Insurance, highlighting its extensive range of services designed to meet diverse healthcare needs.

Private Hospital Coverage

Private hospital coverage is one of the main reasons why many people choose Frank Health Insurance. Having access to private hospitals can mean the difference between waiting months for treatment and receiving immediate care. With Frank, you have several advantages:

- Quick Access to Treatments: There’s nothing more frustrating than waiting months for a necessary medical procedure. With Frank’s private hospital coverage, you can avoid long waiting lists and get the treatment you need more quickly.

- Choice of Doctor: In the public system, you are generally treated by the doctor available at the time. With Frank, you can choose your doctor and ensure continuity of care.

- Comfort and Privacy: Private hospitals offer a higher level of comfort, often with single rooms, providing a more tranquil and private environment for your recovery.

- Support During Pregnancy: For those planning a family, private hospital coverage offers additional peace of mind, allowing you to choose your obstetrician and receive personalized care throughout the pregnancy.

COVID-19 Claims Savings

The COVID-19 pandemic impacted us all in unexpected ways, and Frank Health Insurance responded to this crisis remarkably. During the pandemic, many treatments and procedures were postponed, resulting in significant savings for the company.

Instead of retaining these funds, Frank decided to return these savings to its members, providing financial relief during challenging times.

Return of Savings: Frank Health Insurance returned over $25 million to its members through various initiatives. This included one-time payments for members with active and suspended coverages during the lockdown period.

These reimbursements helped many members cope with the financial difficulties caused by the pandemic.

Continuous Support: In addition to financial returns, Frank also froze premium increases on several occasions, ensuring that members did not face additional costs during an already challenging period.

Furthermore, Frank expanded telehealth benefits, allowing members to continue receiving essential healthcare services from the comfort and safety of their homes. This continuous support was crucial in maintaining the health and well-being of members during the pandemic.

These actions not only alleviated the financial burden on members but also demonstrated Frank Health Insurance’s commitment to caring for and supporting its community in times of crisis.

Waiting Periods

Understanding waiting periods is essential when choosing a health plan. Frank Health Insurance establishes waiting periods to protect both members and the sustainability of the plan. Here are some important details to consider:

New Members: If you are a new member, the waiting periods vary depending on the type of treatment:

- Basic Treatments: The waiting period is 2 months.

- Pre-existing Conditions and Maternity Services: The waiting period is 12 months. This means that if you have a pre-existing medical condition before joining the plan, you will need to wait 12 months for the costs associated with that condition to be covered. Similarly, if you are planning a pregnancy, full coverage for maternity services will only be effective after this period.

Existing Members: If you are already a member and are transferring or upgrading your coverage, the waiting periods for new benefits still apply. However, there are some nuances:

- Access to Previous Benefits: During the waiting period for new benefits, you can still access the benefits of your previous plan. This ensures that you are not left unprotected while waiting for the new benefits to take effect.

- Upgrading Coverage Level: If you are upgrading to a higher level of coverage, the waiting periods will only apply to the additional or expanded benefits of the new coverage level. Benefits that were already available under your previous plan will remain accessible.

Exceptions and Considerations:

- Medical Emergencies: In many cases, emergency treatments are not subject to waiting periods, meaning you can receive immediate care if needed.

- Plan Transfers: If you are transferring from another health plan and have already served the waiting periods under your previous plan, these periods may be recognized and reduced or eliminated by Frank Health Insurance, depending on specific policies.

By understanding and planning according to the waiting periods, you can make more informed choices about your health plan, ensuring that you and your family are always protected.

Coverage for Foreign Visitors

For foreign visitors, having adequate health insurance is crucial to ensure peace of mind during their stay in Australia. Frank Health Insurance offers specific plans tailored to meet the needs of international workers and students, ensuring access to necessary care in any situation.

Customized Plans: Frank Health Insurance provides plans carefully designed to address the specific needs of foreign visitors. These plans include coverage for emergencies, hospitalizations, and a variety of extra services. This ensures you receive the necessary treatment without additional concerns.

Easy Transfer: If you already have health insurance from your home country, Frank Health Insurance facilitates the transfer of coverage, minimizing or eliminating additional waiting periods. This streamlined process ensures you remain protected without interruptions in your access to healthcare services.

Coverage for Extra Services

Extra services are a significant attraction for those seeking comprehensive and complete health coverage. Frank Health Insurance offers a wide range of extra benefits that go beyond basic and hospital care, addressing the diverse needs of its members.

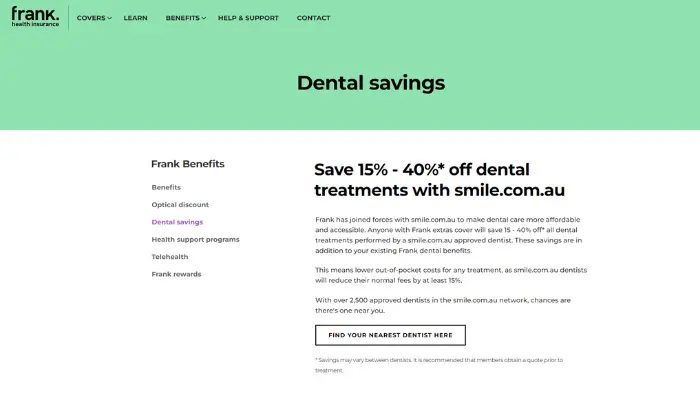

Dental: Dental coverage includes regular check-ups, cleaning, fluoride treatments, and basic extractions. Annual benefits can reach up to $300 per person, providing good coverage to maintain oral health.

Optical: Optical coverage includes prescription glasses, contact lenses, and eye exams. With an annual benefit of $150 per person, you can take care of your vision without worrying about high costs.

Physiotherapy, Chiropractic, and Osteopathy: These combined benefits are essential for physical treatments that help with injury recovery and musculoskeletal health maintenance. Access to physiotherapy, chiropractic care, and osteopathy ensures you have adequate support for physical and mobility issues.

Therapeutic Massage and Acupuncture: Alternative treatment techniques such as therapeutic massage and acupuncture are offered for pain relief and general well-being. These complementary treatments are important for a holistic approach to health, helping to improve the quality of life of members.

Health Plans and Prices

Choosing the right plan can be challenging, but Frank Health Insurance offers a variety of options to suit different needs and budgets.

- Combined Plans: Include hospital coverage and extra services, offering a complete health solution.

- Modular Plans: Allow you to choose only the services you need, such as hospital coverage or just extras, providing flexibility and control over your spending.

Prices are competitive and transparent, with options for weekly, monthly, or annual payments, adapting to your budget and lifestyle.

Maternity and Obstetrics Options

For growing families, having maternity coverage is crucial. Frank Health Insurance offers plans that include comprehensive obstetric care, from prenatal to childbirth.

- Choice of Obstetrician: With private coverage, you can choose your obstetrician, ensuring consistent and personalized care throughout the pregnancy.

- Childbirth Coverage: Includes all expenses associated with childbirth, providing peace of mind for expectant parents.

Choosing Frank Health Insurance ensures you and your family have comprehensive, reliable coverage tailored to your needs.

With benefits ranging from quick access to private hospital treatments to extensive extra services, Frank supports you through every stage of life.

Whether you’re navigating waiting periods or seeking coverage as a foreign visitor, Frank Health Insurance provides the flexibility and care you deserve. Trust Frank to keep you covered and secure.