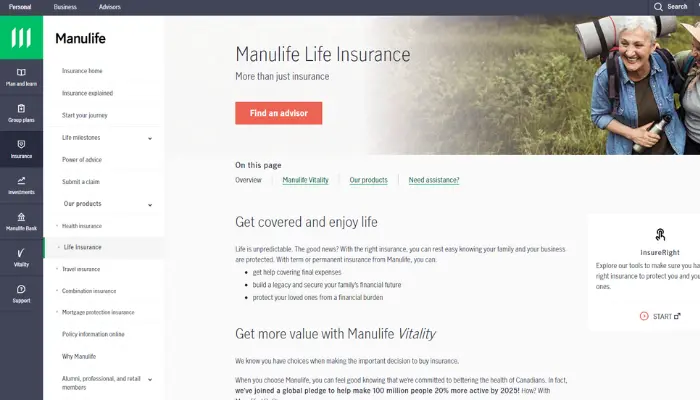

How to Apply for Manulife Life Insurance in Simple Steps

Coverage and Benefits of Manulife Life Insurance

When it comes to protecting your family’s future, Manulife life insurance offers a wide range of coverage options. With it, you can ensure that your loved ones will be financially secure in case something unexpected happens to you.

Manulife life insurance provides various types of coverage, from term life insurance to more comprehensive options like whole life and universal life insurance.

Key Benefits

- Financial Protection: The main advantage of life insurance is that it offers a defined payment amount, known as a death benefit, which will be paid to your beneficiaries upon your passing.

- Flexible Coverage Options: Manulife allows you to customize your policy to meet your specific needs, whether it’s to cover debts, pay for education, or simply provide financial security for your family.

- Additional Benefits (Riders): The ability to add riders to your policy makes it even more comprehensive, offering additional protections such as coverage for disability or critical illness.

In addition to financial security, Manulife life insurance can be a useful tool for long-term financial planning, depending on the type of policy you choose.

Prices and Premiums of Manulife Life Insurance

The cost of life insurance with Manulife can vary widely depending on several key factors, including your age, health status, type of policy, and the amount of coverage you choose.

Manulife provides a range of premium options, making it easier to find a plan that fits both your financial situation and coverage needs.

Key Factors Influencing Premium Costs

- Age: Younger individuals tend to pay lower premiums since they are generally at a lower risk of health complications. Purchasing a policy earlier in life can lock in more affordable rates.

- Health: Your overall health, including any pre-existing conditions, plays a significant role in determining your premium. A medical evaluation may be required to assess your health risk, impacting the final cost.

- Coverage Amount: The higher the coverage amount, the more expensive your premiums will be. It’s important to select a coverage level that meets your family’s financial needs without overextending your budget.

- Policy Type: Whether you choose term life insurance, whole life, or universal life insurance, the type of policy you select will affect the cost. Permanent policies like whole or universal life tend to have higher premiums due to their lifelong coverage and cash value accumulation.

Affordable and Flexible Options

Manulife offers a variety of flexible, affordable life insurance plans tailored for both individuals and families. You can customize your policy by adjusting the coverage level and adding optional benefits (riders) to create a plan that aligns with your budget and long-term goals.

Taking the time to compare the different policy options available can help you secure the best deal for your financial circumstances.

Manulife Life Insurance Options

Manulife offers three main types of life insurance, each with unique characteristics to meet different customer profiles.

Term Life Insurance

This type of insurance is ideal for those looking for a simpler and shorter-term coverage. It offers protection for a predetermined period, such as 10, 20, or 30 years.

If the insured passes away within that period, the benefit is paid to the beneficiaries. However, if the term expires without a claim, the insurance ends without residual value.

Whole Life Insurance

Whole life insurance is for those who want lifelong coverage. This plan accumulates value over time and, besides providing financial protection, can serve as an investment tool.

Manulife allows you to use part of the accumulated value in your policy while you’re still alive, offering more flexibility.

Universal Life Insurance

Universal life insurance combines lifelong protection with a savings component. Manulife offers flexible premium payment options and the ability to adjust the coverage amount over time, providing more strategic financial planning.

How to Apply for Manulife Life Insurance

Applying for life insurance with Manulife is a simple process that can be done online or with the help of an advisor. Here’s a step-by-step guide:

Step-by-Step Application Process

- Assess your needs: The first step is to evaluate how much coverage you need, considering factors such as income, debts, and dependents.

- Choose the type of policy: Based on your needs, you can opt for term life, whole life, or universal life insurance.

- Fill out the application form: Manulife offers an online application option, where you’ll need to provide personal information, details about your health history, and designate your beneficiaries.

- Wait for a health assessment: In some cases, you may need to undergo a medical exam for Manulife to assess your risk and determine the appropriate premium.

- Sign the contract: After approval, you’ll receive the final details of your policy and can complete the process by signing the contract.

Customer Reviews and Experiences

Manulife is known for its customer service and the reliability of its policies. Many customer reviews highlight the clarity of the information provided and the support during the application process.

Positive Points in Reviews

- Fast and efficient service: Many customers report that the application and claims process is straightforward and well-organized.

- Transparency in costs: Manulife stands out for providing detailed information on costs, with no surprises.

- Policy customization: Customers appreciate the flexibility to tailor their policies based on their financial and family needs.

Claims Process and Payment of Benefits

One of the main concerns of policyholders is how the claims process will work if something happens. Manulife aims to make the process as simple as possible.

Step-by-Step Guide for Filing a Claim

- Notify Manulife: The first step is to contact the company and inform them of the need to file a claim.

- Fill out the claims form: Manulife will provide a form that must be completed with details about the claim.

- Submit the required documentation: Typically, you will need to submit documents such as a death certificate and other requested proofs.

- Wait for the review: After submitting the documentation, Manulife will review the claim, and if approved, the payment will be made to the designated beneficiaries.

The processing time can vary, but Manulife strives to ensure the payment is made quickly and without complications.

Additional Benefits and Riders in Manulife Life Insurance

In addition to the basic coverage, Manulife offers a range of additional benefits that can be incorporated into the policy through riders. These riders can be added when purchasing the policy or later, as needed.

Key Riders Available

- Critical Illness Coverage: This rider offers a lump sum payment if the insured is diagnosed with a serious illness, such as cancer or a heart attack.

- Disability: A rider that provides financial protection if the insured becomes unable to work due to permanent disability.

- Waiver of Premium Rider: With this rider, in case of disability, the insured is exempt from paying premiums, but the policy remains in force.

These additional benefits can be an excellent way to enhance your policy’s protection, adapting it to different life scenarios.

Manulife life insurance is an excellent option for those seeking financial security and flexibility. With various coverage options, affordable pricing, and the ability to customize through riders, Manulife stands out as a reliable company in the insurance market.

By following the step-by-step application process and taking advantage of the available additional benefits, you can ensure that your and your loved ones’ needs are fully met.