How Liberty Mutual Business Insurance Can Protect Your Business

Having the right business insurance is essential to protect your company against unexpected events and ensure that operations continue, even during crises.

Advertising

Liberty Mutual, one of the largest and most trusted insurance companies in the United States, offers a wide range of solutions that can be tailored to meet the specific needs of different industries.

Advertising

If you’re looking for comprehensive and flexible coverage, in this article, you’ll understand how Liberty Mutual’s Business Insurance can be the right choice for your company.

We’ll explore the main types of coverage, pricing, and what makes this insurance a robust and efficient solution for small, medium, and large businesses.

Types of Coverage Offered

Advertising

Every business faces unique risks, and Liberty Mutual’s Business Insurance provides a range of coverages designed to protect companies of all sizes. Their flexible insurance plans address various challenges, ensuring businesses stay protected against unexpected events.

From property damage to liability issues, Liberty Mutual has you covered.

- General Liability: Protection against third-party damages, including bodily injury and property damage that may occur during your business operations.

- Commercial Property Insurance: Covers damages to your assets, such as buildings, equipment, and inventory, caused by events like fires, storms, and vandalism.

- Business Interruption Insurance: If your business needs to be halted due to a covered claim, such as a fire or natural disaster, this coverage compensates for the financial losses resulting from the stoppage.

- Product Liability Insurance: Protection against damages or injuries caused by products manufactured or distributed by your company.

- Commercial Auto Insurance: For businesses that own fleets, Liberty Mutual provides comprehensive protection for commercial vehicles.

These are some of the main coverages, but Liberty Mutual offers additional packages and customizations to meet more specific needs, such as professional liability insurance and construction insurance.

Prices and Premium Rates

The cost of a Liberty Mutual Business Insurance policy can vary depending on the type of coverage your company needs, the industry in which it operates, and the size of the business. Some factors that influence pricing include:

- Company Size: Larger businesses with more employees and valuable properties usually pay higher premiums due to increased risk.

- Industry: Sectors like construction or healthcare may have higher premiums as they are considered higher-risk industries.

- Location: Businesses located in areas with higher risks of natural disasters, such as hurricanes or earthquakes, may see an increase in rates.

- Claims History: If your business has a good safety record, with few or no previous claims, this could result in lower premium rates.

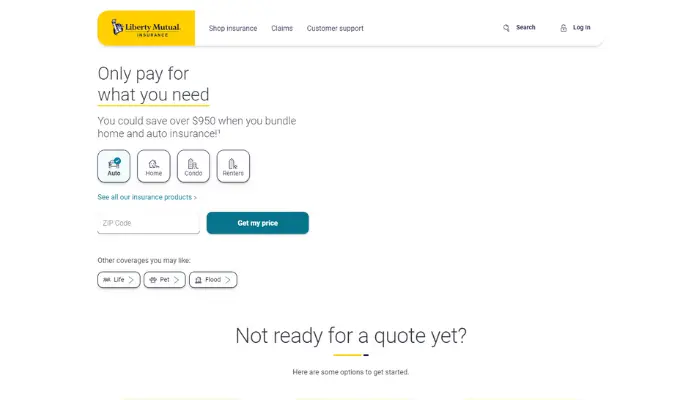

To get a clear idea of the cost, it is essential to get a personalized quote, where Liberty Mutual analyzes all these variables to offer the best value based on your business’s needs.

Cyber Insurance

With the increase in digital threats, protecting your company’s data is crucial. Liberty Mutual offers specific coverage to protect your business from cybercrimes, data theft, and other digital threats.

- Data Breach Protection: Covers costs related to notifying customers about a data breach, recovering information, and even legal actions.

- Cyber Liability: Protects your business against lawsuits that may arise from data security failures or hacking attacks affecting third parties.

- Ransomware Recovery: In cases of data hijacking, this coverage helps cover the costs related to recovering your company’s data and systems.

Cyber insurance is one of the most important coverages today, especially for businesses that rely on technology for their daily operations.

Claims Process

Liberty Mutual stands out for its efficient claims process, offering specialized support to ensure your business gets back to operating as quickly as possible. Here’s how the claims process works:

- Report the Claim: As soon as a covered event occurs, you can report the claim through Liberty Mutual’s website, app, or by phone.

- Claim Evaluation: A specialist is assigned to evaluate the extent of the damage and determine the available coverage for the case.

- Compensation and Repair: After the analysis, Liberty Mutual works with your company to provide the necessary compensation or coordinate the required repairs.

The speed and clarity in the claims process are crucial factors that make Liberty Mutual a reliable choice for many businesses.

Risk Management

In addition to insurance, Liberty Mutual provides comprehensive risk management services to help businesses prevent issues before they arise.

This proactive approach not only improves safety but also reduces the chances of costly claims and keeps premiums lower.

Key services include:

- Personalized Risk Assessments: The Liberty Mutual team analyzes potential risks to your business and offers guidance on how to mitigate them.

- Workplace Safety Programs: Liberty Mutual provides training and tools to help keep your employees safe and reduce the likelihood of accidents and claims.

- Compliance Consulting: Helps ensure that your company complies with all local and federal regulations that may impact your operations.

This proactive support can help reduce claims costs and keep insurance premiums lower.

Industry-Specific Insurance

Every industry has unique risks, which is why Liberty Mutual offers tailored insurance solutions for different sectors. These customized policies ensure that businesses receive the exact protection they need without paying for unnecessary coverages.

Key industries covered include:

- Construction: Coverages that protect your business against risks associated with construction projects and infrastructure development.

- Healthcare: Insurance for hospitals, clinics, and medical offices, with additional protection against lawsuits and professional liabilities.

- Technology: Coverage for IT companies, software developers, and other tech areas, with a focus on data protection and cyber liability.

Industry-specific customization allows your business to have the exact protection needed without paying for unnecessary coverages.

Discounts and Extra Benefits

Liberty Mutual offers several extra benefits and possible discounts for companies that maintain a good safety record. Some of the benefits include:

- No-Claim Discounts: Companies with few or no claims may qualify for reduced rates.

- Discounts for Installing Security Equipment: If your company invests in security systems, such as alarms and cameras, you can get an additional discount.

- Safety Rewards Program: Liberty Mutual offers a program that rewards businesses implementing exemplary safety practices, helping to further reduce insurance costs.

Additionally, the insurer offers extra benefits such as legal assistance and online resources for policy and claims management.

Liberty Mutual’s Business Insurance is a robust and comprehensive solution to protect your business against a variety of risks.

With a wide range of customizable coverages, proactive risk management support, and an efficient claims process, this could be the ideal choice for those looking to ensure business continuity with confidence.

To get the right insurance for your business, it is essential to conduct a detailed analysis of your needs and seek a personalized quote from Liberty Mutual.