Top Benefits of Manulife Dental Coverage for Families

Choosing the right dental insurance plan can be a daunting task, but with Manulife, you have several options tailored to meet your specific needs.

Whether you are a young adult, a growing family, or someone nearing retirement, Manulife offers customizable plans that ensure comprehensive dental care. Let’s explore the main plans available and understand how each can benefit you and your family.

Types of Manulife Dental Insurance Plans

Choosing the right dental insurance plan can be quite challenging. However, Manulife offers several options to meet the diverse needs of its clients. Let’s take a look at the main plans available:

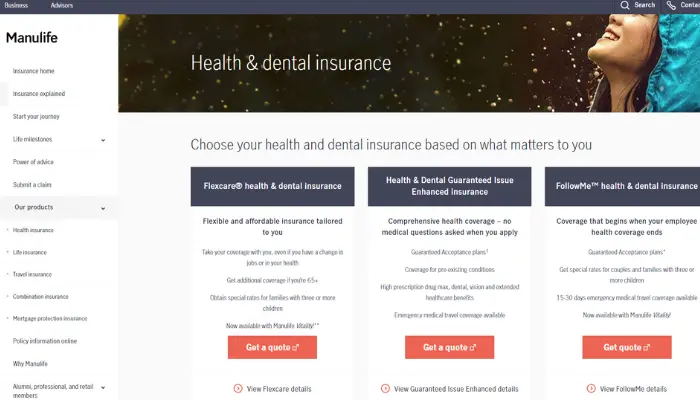

Flexcare

The Flexcare plan is highly customizable, allowing you to choose coverages that best suit your needs and budget.

This plan offers seven distinct options that combine coverage for prescription medications, dental services, vision care, and extended health coverage. With Flexcare, you have the flexibility to adjust the plan as your priorities change over time.

FollowMe

The FollowMe plan is ideal for those about to lose employer-provided benefits due to retirement or job change.

It ensures continuous coverage without the need for medical questionnaires, provided the application is made within a specific period after losing the previous benefit.

This option offers a smooth transition for those who do not want to be without coverage during such life changes.

Health & Dental Guaranteed Issue Enhanced

The Health & Dental Guaranteed Issue Enhanced plan is a great option for those seeking comprehensive coverage without the need for medical questionnaires.

It covers everything from prescription medications to essential dental services and offers additional benefits like vision care and coverage for specialized therapies. This plan is perfect for those looking for a complete health care solution without bureaucratic complications.

Coverage and Benefits

Understanding the coverage and benefits of Manulife dental insurance plans is essential to make the most out of your plan. Let’s explore some of the most important aspects of the coverage offered.

Preventive Care Coverage

Most Manulife dental insurance plans include coverage for preventive care, such as regular exams, cleanings, and X-rays. These services are fundamental for maintaining oral health and preventing more serious problems in the future.

Regular dental visits help detect and treat issues early, avoiding more expensive and invasive treatments later on.

Basic Procedures

Manulife plans also cover basic procedures, such as fillings, simple extractions, and cavity treatments. This coverage ensures that you can take care of common dental problems without worrying about high costs.

Access to these basic treatments is crucial for maintaining oral health and preventing more significant complications.

Major Treatments

For more complex procedures like crowns, bridges, dentures, and oral surgeries, coverage varies depending on the chosen plan.

It is important to review the specific details of your plan to understand which treatments are included and the coverage percentages.

These treatments are generally more expensive, and having insurance that covers a significant portion of the costs can make a big difference in your budget.

Exclusions and Limitations

Each Manulife dental insurance plan has its exclusions and limitations. For instance, some plans may have waiting periods for certain procedures or annual benefit limits.

This means you might need to wait a specific period after purchasing the plan before certain treatments are covered. Additionally, there is a maximum annual amount that the plan will cover for dental services.

It is crucial to carefully read your plan’s contract to understand all the specifics and plan your treatments accordingly.

Plan Costs

The costs of Manulife dental insurance plans can vary considerably depending on the type of coverage chosen and individual needs.

Understanding these variations is essential to choose the plan that best meets your needs and budget. Let’s explore in detail some of the most popular plans and their respective price ranges.

DentalPlus Enhanced

The DentalPlus Enhanced plan offers more robust coverage and, therefore, has a monthly cost ranging between $85 and $100.

In the first year of enrollment, it covers 70% of expenses up to a maximum of $1,200. From the second year onwards, the coverage improves, covering 100% of the first $500 in expenses and 60% of the next $700.

This plan is ideal for those seeking more comprehensive coverage, especially for more complex and costly procedures.

DentalPlus Basic

For those looking for a more affordable option, the DentalPlus Basic plan can be a good choice. This plan has a monthly cost between $70 and $80. In the first year, it covers 50% of expenses up to a maximum of $1,150.

From the second year onwards, the coverage increases to 80% of the first $400 in expenses and 50% of the next $860. Although the initial coverage is lower, it still offers significant protection against high dental treatment costs.

Flexcare Plans

Flexcare plans are highly customizable, allowing users to choose the coverages that best suit their needs and budget. These plans can combine coverage for prescription medications, dental services, vision care, and other types of health coverage.

Costs vary widely depending on the options chosen but generally start around $50 per month and can go up to $150 or more for more comprehensive coverages.

FollowMe

The FollowMe plan is tailored for individuals who are about to lose their employer-provided coverage and seek to maintain similar protection.

This plan typically costs between $75 and $100 per month. One of its key benefits is that it does not require medical questionnaires, making it an easy and convenient option for those needing a seamless transition from their previous coverage.

How to Use Your Dental Insurance at the Dentist

Using your Manulife dental insurance at the dentist may seem complicated, but with these simple steps, you’ll be well-prepared. Here’s a step-by-step guide to ensure you get the most out of your dental insurance plan:

- Bring Your Identification Card

- Always bring your Manulife dental insurance identification card to your first dental appointment. This card contains crucial information, such as your policy number and coverage effective dates.

- Verify Your Coverage

- Your dentist will use your identification card to verify the details of your coverage. This ensures that the treatment you receive is within the covered period and meets the policy’s requirements, helping you avoid unexpected expenses.

- Submit Claims

- With the information from your card, your dentist can begin the claims submission process directly to Manulife. This streamlines the reimbursement process for the costs of your treatment, reducing the hassle for you.

- Request Pre-Authorization

- For more complex procedures, a pre-authorization request might be necessary. Your dentist can use your identification card details to initiate this request, ensuring you know in advance if the procedure will be covered. This step helps prevent any misunderstandings about your coverage and potential out-of-pocket costs.

Waiting Periods and Annual Limits

Manulife dental insurance plans may include waiting periods for certain procedures and annual benefit limits. Understanding these aspects is essential for effectively planning your dental care and avoiding financial surprises.

Understanding Waiting Periods

Waiting periods are intervals you must wait after acquiring the plan before you can use certain benefits. These periods vary depending on the specific plan and type of procedure. Here are some common examples:

Basic Procedures:

- Fillings and cleanings may have a waiting period of about 6 months. This means that after purchasing your plan, you will need to wait six months before these procedures are covered.

Major Treatments:

- Procedures such as crowns, bridges, and dentures generally have longer waiting periods, often up to 12 months. This is to prevent individuals from obtaining insurance solely to cover immediate expensive treatments.

Annual Limits

Each Manulife dental insurance plan sets an annual benefit limit, which is the maximum amount the plan will pay per year for dental services.

These limits vary depending on the plan and are important for financial planning. Here are some examples of how these limits can be structured:

Basic Care:

- Some plans may have a limit of $750 per year for basic procedures such as cleanings, fillings, and simple extractions. This limit is designed to cover regular maintenance and preventive care.

Major Treatments:

- For more complex treatments, such as crowns, bridges, and oral surgeries, the annual limit may be higher, for example, $1,200 per year. This helps cover a significant portion of the costs but may still leave some expenses for the patient.

Additional Benefits

In addition to traditional benefits, Manulife offers several additional advantages that can make your plan even more valuable and comprehensive.

Let’s explore some of these extra benefits that can provide greater peace of mind and promote healthy habits for you and your family.

Travel Coverage

For those who love to travel, some Manulife dental insurance plans include emergency medical coverage during trips. This means that if you face a dental health emergency while away from home, you can count on assistance and financial coverage.

This benefit is especially useful for frequent travelers, providing peace of mind and ensuring you are protected no matter where you are.

Wellness Programs

Manulife offers wellness programs like Manulife Vitality, which encourage healthy habits among policyholders. Participating in this program can bring various rewards:

- Rewards for Healthy Activities: The program offers points and prizes for activities such as regular physical exercise, medical and dental check-ups, and participation in nutrition courses. These points can be redeemed for discounts on premiums or even a reduction in your insurance premium.

- Health Monitoring: Manulife Vitality also provides tools to monitor and improve your overall health. This includes access to health assessments, personalized physical activity goals, and educational resources to help you maintain a healthy lifestyle.

Family Benefits

Many Manulife dental insurance plans allow the inclusion of dependents, ensuring that the entire family has access to adequate dental care. This includes:

- Coverage for Spouses and Children: Your dependents, such as spouses and children, can be included in your plan, offering them the same coverage benefits you receive. This is particularly useful for families seeking an integrated dental care solution.

- Preventive Treatments for Children: The plans often cover essential preventive care for children, such as dental sealants and fluoride applications, helping to maintain oral health from an early age and prevent future problems.

Access to Specialists

In addition to general dentists, some Manulife plans offer access to a network of specialists, including orthodontists, periodontists, and oral surgeons.

This specialized network ensures that you and your family receive the best possible care for any complex dental needs.

Additional Hospital and Therapy Benefits

Some advanced Manulife plans may include coverage for additional therapies, such as physiotherapy and massage therapy, and even hospitalization coverage in cases of severe dental emergencies.

This provides an extra layer of security and care for you and your family.

Eligibility and Requirements

To qualify for a Manulife dental insurance plan, you need to meet certain basic criteria. Here are the key requirements you should be aware of:

Age and Residency

- You must be over 18 years old and a resident of Canada.

- Additionally, you must be covered by a provincial or territorial health plan.

Dependents

- You can include dependents in your plan, such as:

- Your spouse.

- Unemployed dependent children under the age of 21.

Application

- For some plans, especially FollowMe, you need to enroll and pay the first premium within a specific period after losing your previous employer-provided benefit. This period is usually short, so be mindful of the deadlines.

Necessary Documentation

- When applying, you will need to provide:

- Basic personal information, such as name, address, and date of birth.

- Basic medical details, if necessary, depending on the chosen plan.

- Ensure you have all the required documents on hand to streamline the application process.

Understanding the coverage and benefits, including preventive care and major treatments, is essential. Additionally, extra benefits like travel coverage and wellness programs make the plans even more valuable.

Considering the costs and using the insurance efficiently at the dentist will help you maximize your plan’s benefits. Knowing the eligibility criteria and having the necessary documentation ready will expedite the enrollment process.