Is Manulife Travel Insurance Worth It? See the Full Review

Traveling is an exciting and enriching experience, but it can also bring some concerns, especially when it comes to unforeseen events. That is why it is essential to ensure your trip is safe and protected against any eventualities.

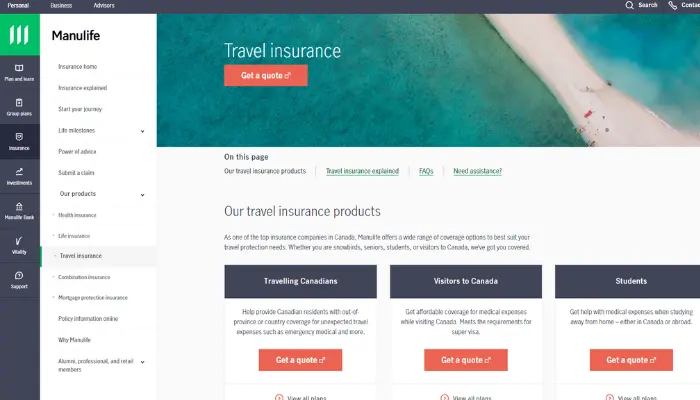

Manulife Travel Insurance is a popular option among travelers who want peace of mind during their adventures. In this article, we will explore the main aspects of this travel insurance, ensuring you are well-informed before embarking on your journey.

Coverage for Medical Emergencies While Traveling

One of the biggest concerns for travelers is how to deal with a medical emergency in a foreign country. Manulife Travel Insurance offers comprehensive coverage for medical emergencies, ensuring you do not have to worry about unexpected healthcare expenses.

With medical emergency coverage, you can count on:

- Emergency medical care: Includes medical consultations, hospital treatment, prescribed medications, and necessary procedures in emergency cases.

- Emergency medical transportation: If necessary, the insurance covers transportation to an appropriate hospital or even return to your home country for treatment.

- 24-hour medical assistance: Manulife offers 24-hour medical support, ensuring you receive help at any time during your trip.

Traveling without proper insurance can be risky, as medical costs in foreign countries can be exorbitant. With Manulife Travel Insurance, you can enjoy your trip with peace of mind, knowing you are protected against unforeseen situations.

Prices and Options for Travel Insurance Plans

Manulife offers a variety of travel insurance plans, each tailored to the specific needs of travelers. Whether you are planning a short trip or an extended stay, there is a plan for you.

Available Plan Options:

- Basic Plan: Ideal for short trips with a focus on essential protection. Includes medical emergencies and trip cancellation coverage.

- Comprehensive Plan: Recommended for international trips, offering comprehensive coverage, including medical emergencies, cancellation, trip interruption, and lost baggage.

- Annual Plan: For those who travel frequently, the annual plan is a convenient and cost-effective option, covering all trips within a 12-month period.

Factors That Influence Price:

- Trip duration: The longer your trip, the higher the cost of the insurance.

- Destination: Trips to countries with high medical costs tend to have higher premiums.

- Traveler’s age: Older adults generally pay higher premiums due to the increased risk of medical complications.

Reimbursement Process for Manulife Travel Insurance

The reimbursement process is one of the main concerns for policyholders, especially when unexpected situations arise during a trip.

Understanding how this process works is essential for you to travel with more peace of mind. Manulife offers a clear and efficient process to ensure you are reimbursed quickly, without complications.

Step-by-Step to Request Reimbursement:

- Notify Manulife: As soon as a covered incident occurs, contact Manulife as soon as possible to notify them.

- Gather the Necessary Documents: You will need receipts such as medical bills, hospital reports, and expense invoices. Be sure to keep all original documents.

- Fill Out the Reimbursement Form: Complete the reimbursement form provided by Manulife, including all necessary details about the incident.

- Submit the Documents: Send the completed form and all receipts to Manulife, either online or by mail.

- Track the Process: You can track the status of your reimbursement directly on Manulife’s website or by contacting customer service.

Having travel insurance is not just about coverage, but also about the ease of the reimbursement process. Manulife strives to make this process as simple and quick as possible.

Coverage for COVID-19 and Infectious Diseases

The COVID-19 pandemic has drastically changed the way we travel. Fortunately, Manulife Travel Insurance offers coverage for situations related to COVID-19 and other infectious diseases, providing greater peace of mind for travelers.

What Is Covered?

- Medical expenses related to COVID-19: Includes treatment and hospitalization if you contract COVID-19 during the trip.

- Trip Cancellation and Interruption: If you need to cancel or interrupt your trip due to a positive COVID-19 test, the insurance covers eligible expenses.

- Forced Quarantine: Additional costs due to a forced quarantine may also be covered, depending on your plan’s terms.

Traveling during a pandemic requires extra preparation, and having a policy that includes COVID-19 coverage can make all the difference in your peace of mind.

Coverage for Trip Cancellation and Interruption

Unforeseen events can happen at any time, which is why Manulife offers coverage for trip cancellation and interruption. This means that if something goes wrong and you need to cancel or interrupt your trip, you will not lose your investment.

Common Reasons for Cancellation or Interruption Covered:

- Health issues: If you or an immediate family member becomes ill before or during the trip.

- Unexpected family events: Such as death or emergencies involving close family members.

- Transportation issues: Includes flight cancellation or transportation problems due to adverse weather conditions.

Canceling a trip is something no one wants to face, but having adequate coverage ensures you will be reimbursed for expenses that would otherwise be lost.

Additional Benefits and Lost Baggage Coverage

In addition to medical and cancellation coverage, Manulife Travel Insurance offers a range of additional benefits that provide more security and comfort for you to enjoy every moment of your trip.

These benefits are designed to make your travel experience even better, even in the face of unforeseen events.

Coverage for Lost, Delayed, or Damaged Baggage:

- Lost Baggage: Reimbursement for lost items if your baggage is permanently lost by the airline.

- Delayed Baggage: If your baggage is delayed, the insurance covers the cost of essential items until your baggage is returned.

- Damaged Baggage: If your baggage is damaged during transportation, Manulife covers the cost of repair or replacement of the items.

Other Benefits Include:

- Legal Assistance: If you need legal assistance during the trip.

- Trip Delay Coverage: Reimbursement of expenses related to significant delays in your itinerary.

These additional benefits ensure that, regardless of what happens, you are covered and can deal with unforeseen events more calmly.

Reviews and Experiences of Customers with Manulife Travel Insurance

Before purchasing travel insurance, it is always good to hear what other travelers have to say. Customer reviews are an excellent way to understand the strengths and weaknesses of any product.

What Do Customers Say?

- Customer Service: Many customers praise Manulife’s customer service, highlighting the speed and efficiency in solving problems and answering questions.

- Reimbursement Process: Most customers state that the reimbursement process is simple and straightforward, which is a positive point compared to other insurers.

- Peace of Mind During the Trip: Customers who had emergencies during the trip emphasize how the 24-hour support made a difference in stressful situations.

Some Tips from Customers:

- Always read the terms and conditions to understand exactly what is covered.

- Have all the necessary documents on hand to facilitate the reimbursement process.

Customer experiences show that Manulife Travel Insurance is a solid choice for those seeking safety and support during their travels.

Manulife Travel Insurance is a reliable option for travelers who want to ensure a safe experience. With coverage ranging from medical emergencies to lost baggage protection, Manulife insurance offers the essentials for a smooth trip.

Choose a plan that suits your needs and travel with confidence.

We hope this article has clarified your doubts about Manulife Travel Insurance. For more information or assistance in choosing the best plan, contact Manulife or visit the official website.