Protect Your Motorcycle with Wawanesa: Coverage and Discounts

If you are looking for reliable and affordable motorcycle insurance, Wawanesa motorcycle insurance might be the ideal solution for you.

With a solid reputation and years of market experience, Wawanesa stands out for its quality customer service and a wide range of coverages offered.

In this article, we will explore in detail everything you need to know about Wawanesa motorcycle insurance, from costs to offered coverages, available discounts, customer reviews, and much more.

Our goal is to provide a comprehensive view to help you make the best decision to protect your motorcycle.

Cost of Motorcycle Insurance

The cost of motorcycle insurance is one of the main concerns for any motorcyclist. With Wawanesa motorcycle insurance, the price can vary significantly depending on several factors. Here are some important points that influence the cost:

- Motorcycle Model: Higher displacement or sports models tend to have higher premiums due to the increased risk associated.

- Driver’s Age: Younger drivers, especially those under 25, generally face higher premiums.

- Driving History: A clean driving history with few or no infractions can significantly reduce insurance costs.

- Location: Where you live and where the motorcycle is used can affect the price. Areas with higher theft or accident rates can result in higher premiums.

Offered Coverages

Wawanesa offers a comprehensive variety of coverages to meet motorcyclists’ needs, ensuring protection in various situations:

Liability Coverage: This coverage is essential for protecting against property damage and bodily injury caused to third parties in an accident. It covers legal costs, medical expenses, and necessary repairs, helping to avoid significant personal expenses in the event of an incident.

Collision Coverage: Covers damages to your motorcycle in case of a collision, regardless of fault. This coverage is crucial to ensure that you can repair or replace your motorcycle after an accident, minimizing financial impact.

Comprehensive Coverage: Goes beyond collisions, protecting your motorcycle against a variety of unforeseen events, such as theft, vandalism, fire, and natural disasters. With this coverage, you have the peace of mind knowing your motorcycle is protected against various risks.

Roadside Assistance: Offers a range of emergency services, including towing, tire changes, and assistance in case of a breakdown. This support is vital for motorcyclists, ensuring you are not stranded in a difficult situation without help.

Rental Reimbursement: Covers rental vehicle costs while your motorcycle is being repaired after a covered claim. This coverage ensures you are not without transportation during the repair period, maintaining your routine without major interruptions.

Wawanesa strives to offer coverages that provide security and convenience, allowing you to choose the options that best meet your individual needs.

Discounts and Promotions

Wawanesa offers several discounts to help reduce the cost of motorcycle insurance:

- Good Driver Discount: Drivers with a clean driving record may qualify for reduced premiums.

- Multi-Vehicle Discount: Insuring more than one vehicle with Wawanesa results in significant savings.

- Security Device Discount: Installing alarms, trackers, and other security devices can lower your insurance premium.

- Loyalty Discount: Long-term customers receive additional discounts as a reward for their loyalty.

- Defensive Driving Course Discount: Completing defensive driving courses can qualify you for additional discounts.

- Pay-in-Full Discount: Paying the full insurance premium upfront can result in a discount.

These discounts make Wawanesa motorcycle insurance more affordable and tailored, encouraging safe driving and the use of additional safety measures.

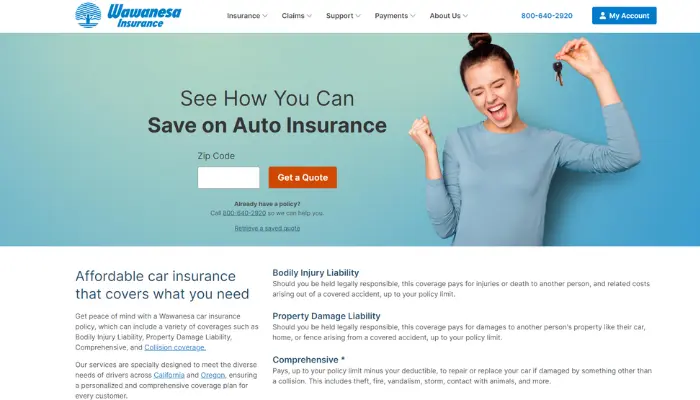

Quotation and Purchase Process

Obtaining a quote and purchasing Wawanesa motorcycle insurance is a straightforward and streamlined process. Here is a step-by-step guide to assist you:

1. Visit the Wawanesa Website: Start by accessing the official Wawanesa website and navigating to the motorcycle insurance section.

2. Fill Out the Quotation Form: Provide essential details, such as the motorcycle model, year of manufacture, primary use, and basic personal information. This step ensures that Wawanesa can generate an accurate quote based on your specific circumstances.

3. Receive Your Quote: Once you have submitted the required information, Wawanesa will generate a personalized quote. This quote will reflect the estimated cost of insuring your motorcycle based on the provided details.

4. Compare and Adjust Coverages: Review the coverage options included in the quote. You can adjust the coverages to better match your needs and budget. This may involve selecting higher or lower coverage limits, adding optional coverages, or changing deductibles.

5. Finalize the Purchase: After selecting your desired coverages and ensuring the quote meets your requirements, you can finalize the purchase.

This can be done online through the Wawanesa website or by contacting a Wawanesa representative who can assist you in completing the process.

Additional Tips:

- Prepare Documentation: Have your motorcycle details and personal information readily available to streamline the process.

- Seek Assistance if Needed: If you have any questions or need further clarification, Wawanesa’s customer service representatives are available to help you.

- Review Policy Details: Before finalizing, make sure to thoroughly review the policy details to understand the terms and conditions.

By following these steps, you can efficiently obtain a quote and secure the right motorcycle insurance coverage from Wawanesa, ensuring your peace of mind on the road.

Tips for Saving on Insurance

Saving on motorcycle insurance is possible with some smart strategies. Here are a few tips that can help:

- Compare Quotes: Always compare quotes from different insurance providers before making a decision.

- Adjust Coverages: Evaluate your needs and avoid paying for unnecessary coverages.

- Increase the Deductible: Opting for a higher deductible can reduce your insurance premium, but remember you will pay more out-of-pocket in case of a claim.

- Security Discounts: Install insurer-approved security devices to qualify for possible discounts.

- Maintain a Clean Driving Record: Drivers with no claims or infractions tend to receive better rates.

- Annual Payment: If possible, choose to pay annually instead of monthly to save on the total cost.