Benefits of Real-Time Payments (RTPs)

The world of finance is undergoing a significant transformation with the emergence of Real-Time Payments (RTPs).

Advertising

Whether you’re familiar with this innovation or just beginning to explore the topic, in this article, we will explain how RTPs work, their benefits and challenges, as well as provide real-world examples of this technology in action.

Advertising

Ready to understand how RTPs can impact both your personal life and your business? Let’s dive in!

How Real-Time Payments (RTPs) Work

Real-Time Payments (RTPs) enable money to be transferred instantly between bank accounts, 24/7.

Advertising

This means that when you make a payment, the money moves from your account and reaches the recipient in seconds, without waiting for conventional banking hours or business days.

Basic RTP Structure:

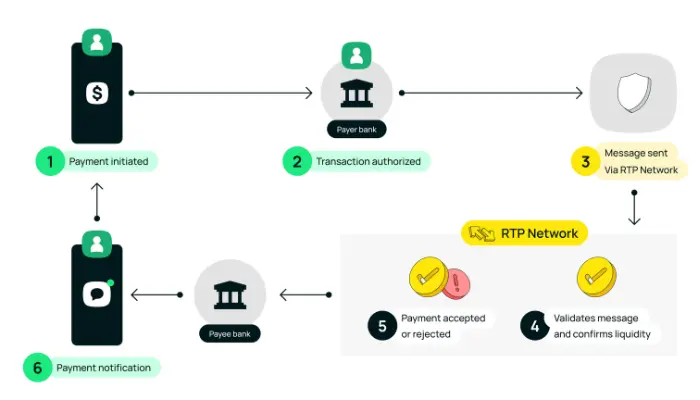

- Initiating the Transaction: The payer starts a transaction, whether through a banking app or payment system.

- Validation and Authorization: The real-time payment system validates the transaction in seconds, checking the data and the availability of funds.

- Instant Settlement: Once the transaction is authorized, the funds are transferred from one account to another without delay, unlike traditional transfers, which can take days.

- Immediate Confirmation: Both the payer and the recipient receive an instant confirmation of the completed transaction.

This infrastructure is enabled by specialized RTP networks, such as FedNow in the U.S., the European SEPA system, and PIX in Brazil.

Benefits of Real-Time Payments for Businesses and Consumers

Real-Time Payments offer a variety of benefits for businesses and consumers that rely on quick and secure financial transactions.

Let’s explore how these advantages can directly impact your daily life and business operations.

For Businesses:

- Improved Cash Flow: Instant payments allow businesses to access funds immediately, eliminating the need to wait days for settlement. This is especially useful for small businesses that rely on continuous cash flow.

- Reduced Operational Costs: With faster transactions, operational costs, such as processing fees, can be reduced, and the need for temporary credit to cover payment gaps is minimized.

- Increased Customer Satisfaction: Offering a fast and efficient payment method enhances the customer experience, making transactions easier and increasing trust in the company.

For Consumers:

- Convenience: Consumers can make payments at any time, without the need to wait for business days or banking hours.

- Financial Control: With instant settlement, it’s easier for consumers to track and manage their finances in real time, knowing exactly what has left their account immediately.

- Increased Security: The RTP system uses advanced authentication and encryption, making the payment process more secure than traditional methods.

Differences Between Real-Time Payments and Traditional Transfers

While Real-Time Payments (RTPs) represent a significant innovation in the financial world, many people still wonder how they differ from traditional bank transfers.

The most notable distinction is the speed: RTPs are instant, allowing funds to be transferred in seconds, whereas traditional transfers can take anywhere from one to three business days.

Another key difference is availability. RTPs operate 24/7, including holidays, while traditional transfers are limited to banking hours and business days.

When it comes to cost, RTPs tend to be more affordable, often with lower fees compared to the sometimes higher costs associated with traditional methods.

Confirmation of transactions in RTPs is immediate, giving both parties assurance that the payment has been completed. Traditional transfers, on the other hand, may take hours or even days for confirmation.

Lastly, security in RTPs is highly advanced, utilizing modern encryption and authentication technologies, making them more secure compared to older transfer systems.

These features make RTPs an ideal solution for anyone needing fast, reliable, and secure transactions.

Security in Real-Time Payments

Security is a top concern in financial transactions, especially with the speed of Real-Time Payments (RTPs).

Fortunately, RTP systems are built with advanced security protocols that offer multiple layers of protection, ensuring safety without compromising the convenience of instant payments.

Common Security Measures in RTPs:

- Multi-Factor Authentication: Requires verification through multiple methods, like passwords or biometrics, to prevent unauthorized access.

- Data Encryption: Encrypts all data during transactions, making it inaccessible to third parties.

- Real-Time Monitoring: Detects suspicious or fraudulent activity instantly, allowing for immediate response.

- Strict Regulation: RTP systems follow rigorous rules from regulatory bodies, ensuring secure and auditable transactions.

These features make RTPs a secure and reliable choice for fast financial transactions.

Examples and Global Adoption of RTPs

Many countries have already adopted real-time payments as a standard. Let’s take a look at some examples of how this technology is being used around the world.

Examples of RTPs Worldwide:

- United States: FedNow is the RTP system being rolled out to enable instant transactions nationwide.

- Brazil: PIX, launched by the Central Bank of Brazil, allows millions of Brazilians to make transactions within seconds, at any time of the day.

- United Kingdom: Faster Payments has been the system allowing fast transfers between banks in the UK since 2008.

Growing Adoption:

The adoption of RTPs is growing rapidly. According to recent reports, the volume of real-time transactions is expected to reach $1.2 trillion by 2025 as more consumers and businesses see the benefits of this technology.

Impact of RTPs on the Banking Sector and Fintechs

RTPs are transforming the banking sector and the way fintechs operate. Traditional banks are under pressure to modernize their infrastructures, while fintechs leverage the agility and flexibility of RTPs to offer new services.

Key Changes:

- Increased Competitiveness: Fintechs are using RTPs to launch innovative financial products, while traditional banks are racing to keep up.

- New Business Models: The emergence of RTPs has paved the way for business models based on microtransactions and real-time financial services, such as quick loans and insurance.

- Strategic Partnerships: Many fintechs are partnering with banks to offer faster and more secure RTP services to consumers.

Regulation and Compliance for RTPs

As with any emerging financial technology, Real-Time Payments (RTPs) are subject to stringent regulations to ensure their secure and ethical use.

Regulatory frameworks are critical for protecting consumers, maintaining system integrity, and fostering trust in this rapidly expanding form of payment.

In the U.S., compliance with guidelines from organizations such as the Federal Reserve and the Consumer Financial Protection Bureau (CFPB) is essential for any entity looking to implement or utilize RTP systems.

The regulatory landscape is constantly evolving to keep pace with advancements in real-time payment technologies, ensuring that all transactions are secure, transparent, and auditable.

It is crucial for businesses, financial institutions, and service providers to stay up to date with these regulations and implement the necessary compliance measures.

Steps to Ensure Compliance:

- Check Local Regulations: Businesses need to be aware of the specific regulations regarding RTPs in their jurisdictions.

- Adopt Compliance Measures: Implement data protection policies and ensure that all transactions are auditable.

- Educate Customers and Employees: Ensure that everyone involved in the transactions understands the legal requirements and the importance of following compliance rules.

Real-Time Payments (RTPs) are transforming the way we move money. With benefits such as speed, security, and convenience, both consumers and businesses stand to gain from this technology.

As the adoption of RTPs grows globally, it is important to stay aware of regulations and the new opportunities arising in this space. Whether you’re a business owner or a consumer, RTPs are ready to become part of your financial future.