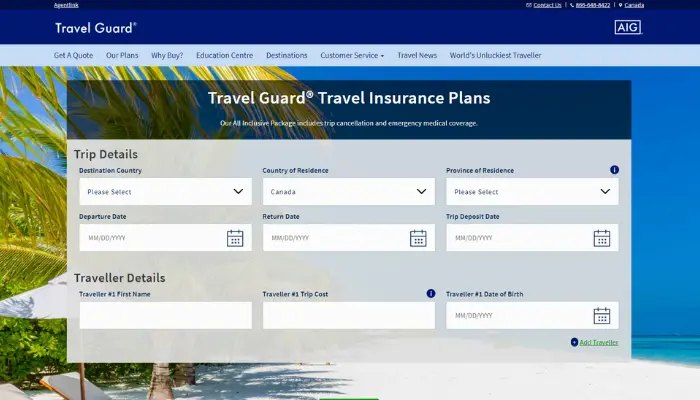

Travel Guard: Complete Protection for Worry-Free Travel

Traveling is a unique and exciting experience, but unforeseen events can happen. Therefore, having reliable travel insurance, like Travel Guard Canada, is essential to ensure peace of mind in any situation.

I will explain in detail the coverages that Travel Guard Canada offers, how the reimbursement process works, and what plans are available for you and your family. This way, you can travel knowing you are well protected.

Trip Cancellation Coverage

Unexpected events can occur at any time, and having to cancel a trip is a situation that no traveler wants to face. However, with Travel Guard Canada’s trip cancellation coverage, you can reduce the financial impact of such a decision.

Trip cancellation coverage offers protection in cases of cancellation due to unforeseen reasons, such as health issues, family emergencies, or even severe weather conditions that prevent travel.

Covered Reasons for Cancellation:

- Serious health problems (including COVID-19).

- Death of close family members.

- Significant damage to your home (fire or flood).

- Unexpected changes at work (such as job loss).

One of the advantages of Travel Guard Canada is that by covering cancellations for these reasons, you can recover the amounts already paid for tickets and accommodations, avoiding greater financial losses.

Emergency Medical Coverage Abroad

No matter how well-planned your trip is, medical emergencies can arise. And when we are outside our country, medical care costs can be exorbitant.

This is why Travel Guard Canada includes emergency medical coverage abroad, helping you deal with expenses ranging from consultations to hospitalizations.

This coverage is ideal for ensuring immediate care in case of accidents or unexpected health problems. It can include everything from ambulance transportation to medical repatriation if it is necessary to return to Canada for proper treatment.

Main Benefits of Medical Coverage:

- Emergency medical consultations.

- Hospital care and hospitalization.

- Repatriation in case of medical emergency.

- Prescribed medications for emergency treatment.

Traveling with this coverage gives you the peace of mind that any unforeseen event will be resolved without you having to worry about the high costs of medical care.

Reimbursement and Claims Process

Understanding how the reimbursement process works is essential to ensure that you are prepared if you need to activate the insurance. Fortunately, the reimbursement and claims process with Travel Guard Canada is simple and straightforward.

Step-by-Step to Request Reimbursement:

- Notification: Notify Travel Guard Canada about the incident as soon as possible.

- Fill Out the Form: Complete the claim form provided by the insurer. Make sure to include all relevant information.

- Submit Documents: Submit the necessary documents, such as receipts, medical reports, incident reports, or proof of payment.

- Follow-Up: Track the status of your claim through the customer portal or with support.

- Receive Reimbursement: Once approved, you will receive the reimbursement amount directly into your bank account.

The tip is always to keep documents on hand and not forget to report the incident immediately to avoid complications.

Coverage for Lost or Delayed Baggage

Losing baggage is one of the biggest headaches for any traveler. However, with Travel Guard Canada, you can have financial support to deal with this situation.

Covered Situations:

- Lost Baggage: If your baggage is lost during the trip, the insurance coverage will reimburse the costs of essential lost items.

- Delayed Baggage: If your baggage is delayed for a period longer than a predetermined time (usually 6 hours), you may be reimbursed for essential items you need to purchase, such as clothing and hygiene products.

This way, you can continue your trip comfortably, even if your baggage is not with you.

Trip Interruption Coverage

If an unforeseen event arises during the trip and you need to return to Canada earlier than expected, trip interruption coverage can help you.

This coverage applies in situations such as medical emergencies, the death of a family member, or even unexpected events at home, such as fires or floods.

What Is Included:

- Reimbursement of non-refundable expenses, such as hotel stays and unused tours.

- Additional transportation costs to return to Canada.

This is a way to protect your investment in the trip and ensure that you do not incur losses if you need to interrupt your plans.

Coverage for Trips Canceled Due to COVID-19

With the COVID-19 pandemic, various concerns have arisen regarding the feasibility of international travel. Travel Guard Canada offers specific coverage for cancellations related to COVID-19, allowing you to travel with more peace of mind.

Covered Cases:

- Positive COVID-19 Test: If you or a family member tests positive for COVID-19 before the trip, the costs will be reimbursed.

- Mandatory Quarantine: If you are required to enter quarantine due to a local outbreak or government decree, the coverage also applies.

Staying up to date on travel guidelines and entry and exit requirements is essential to ensure you are covered in all COVID-19-related circumstances.

Travel Insurance Plans for Families

Traveling with family is an opportunity to create unforgettable memories, and nothing is better than ensuring everyone is protected.

Travel Guard Canada offers specific plans for families, covering everyone from the youngest to the oldest members.

Benefits of Family Plans:

- Package Discounts: By purchasing a family plan, you can access significant discounts.

- Complete Coverage for Everyone: All family members have access to cancellation, medical emergency, and baggage coverage.

- Simplified Process: With a single plan, you protect the whole family, avoiding unnecessary bureaucracy.

Whether an international trip or a trip closer to home, family travel insurance plans are designed to ensure that everyone is protected and can enjoy the trip to the fullest.

Having travel insurance is not just about preventing unexpected expenses – it is about ensuring that you can travel with peace of mind, knowing that you are prepared to handle any unforeseen event.

Travel Guard Canada offers a wide range of coverages that adapt to the needs of every traveler, from individual to family plans, ensuring that each one can have a safe and worry-free experience.

Therefore, when planning your next trip, consider all possibilities and choose the coverage that best suits your profile and needs. Travel Guard Canada is here to ensure nothing spoils your plans, leaving you free to create unforgettable memories.