Wells Fargo Reflect Credit Card: How to Apply, Advantages and Costs

If you are looking for a credit card that offers exclusive advantages and special conditions, the Wells Fargo Reflect credit card might be the ideal choice for you.

With a range of benefits, including competitive interest rates and extensive coverage, this card stands out in the financial market. In this article, we will explore how to apply for the card, who is eligible, its main benefits, associated fees, and much more.

Keep reading to find out everything you need to know about the Wells Fargo Reflect and how it can meet your financial needs.

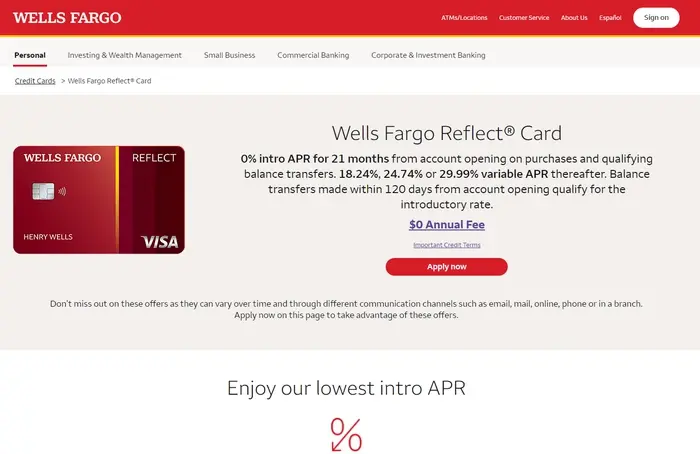

How to apply for the Wells Fargo Reflect Card

Applying for the Wells Fargo Reflect credit card is a straightforward process, and it can be done entirely online. Here’s a step-by-step guide to help you get started:

Step 1: Visit the Wells Fargo Website

Begin by navigating to the official Wells Fargo website. Look for the credit cards section and find the Wells Fargo Reflect card. You can also use the search bar on the website to locate the card quickly.

Step 2: Review the Card Details

Before applying, take some time to review the card’s features, benefits, and terms. Make sure the Wells Fargo Reflect card aligns with your financial needs and goals. Pay particular attention to the interest rates, fees, and rewards program.

Step 3: Click on “Apply Now”

Once you are ready, click on the “Apply Now” button. This will direct you to the online application form. Ensure that you have all necessary information and documents on hand, such as your Social Security number, income details, and employment information.

Step 4: Complete the Application Form

Fill out the application form with accurate information. You will need to provide personal details, including your name, address, and contact information. Additionally, you’ll need to supply financial information such as your income, employment status, and any other relevant details.

Step 5: Submit the Application

After completing the form, review all the information you have entered to ensure accuracy. Once you are satisfied, submit the application. Wells Fargo will then review your application and conduct a credit check to determine your eligibility.

Step 6: Await Approval

Approval times can vary, but you will typically receive a response within a few business days. If approved, you will receive your Wells Fargo Reflect card in the mail, along with instructions on how to activate it and start using it.

Advantages of the Card

The Wells Fargo Reflect card offers a range of benefits designed to provide value and convenience to its users. Here are the key advantages:

1. 0% Introductory APR

- Extended Intro Period: Enjoy a 0% introductory APR on purchases and qualifying balance transfers for an extended period, helping you save on interest.

- Great for Big Purchases: Ideal for financing large purchases or consolidating existing debt without the burden of immediate interest charges.

2. No Annual Fee

- Cost-Effective: No annual fee means you can enjoy the card’s benefits without worrying about an additional yearly cost.

- Budget-Friendly: Makes it easier to manage your finances without extra fees eating into your budget.

3. Flexible Repayment Options

- Payment Flexibility: Offers various repayment options to suit your financial situation, making it easier to stay on top of your payments.

- Convenient Management: Allows you to manage your payments through the Wells Fargo mobile app or online banking.

4. Robust Security Features

- Zero Liability Protection: Provides zero liability protection against unauthorized transactions, ensuring your account is safe.

- Fraud Monitoring: Continuous monitoring for suspicious activity to help protect your account.

5. Access to Credit Tools and Resources

- FICO Credit Score: Free access to your FICO credit score, helping you stay informed about your credit health.

- Financial Education: Access to a variety of financial tools and educational resources to help you manage your credit responsibly.

6. Customer Support

- 24/7 Support: Round-the-clock customer service for any queries or issues you may encounter.

- Comprehensive Assistance: Assistance available through multiple channels, including phone, online chat, and in-person at Wells Fargo branches.

7. Mobile App Integration

- Account Management: Manage your card, pay bills, and monitor transactions through the Wells Fargo mobile app.

- Alerts and Notifications: Set up alerts and notifications to stay updated on your account activity.

8. Contactless Payments

- Tap to Pay: Convenient and secure contactless payment option for quicker transactions.

- Wide Acceptance: Accepted at millions of locations worldwide, making it easy to use wherever you go.

9. Balance Transfer Capability

- Debt Consolidation: Transfer balances from high-interest credit cards to take advantage of the 0% introductory APR period.

- Lower Interest Costs: Save on interest by consolidating your debt onto the Wells Fargo Reflect card.

By taking advantage of these features, the Wells Fargo Reflect card can be a valuable tool in managing your finances effectively and securely.

Requirements to Apply for the Wells Fargo Reflect Card

To apply for the Wells Fargo Reflect credit card, you need to meet certain eligibility criteria. Here are the minimum requirements:

1. Age Requirement

- Minimum Age: Applicants must be at least 18 years old. In some states, the minimum age may be higher due to specific state laws.

2. Citizenship or Residency Status

- U.S. Citizen or Resident: Applicants must be U.S. citizens or permanent residents with a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

3. Credit History

- Good Credit Score: A good to excellent credit score is typically required. This usually means a FICO score of 670 or higher.

- Credit Report: A stable and positive credit history with no recent bankruptcies, charge-offs, or significant delinquencies is preferred.

4. Income Verification

- Steady Income: Proof of a steady income is necessary to demonstrate your ability to repay any credit extended. This can include employment income, self-employment income, or other verifiable sources of income.

- Debt-to-Income Ratio: A reasonable debt-to-income ratio, indicating that your monthly debt obligations are manageable relative to your monthly income, is also considered.

5. Identification

- Valid ID: A government-issued photo ID, such as a driver’s license, passport, or state ID card, is required to verify your identity.

6. Contact Information

- Permanent Address: A valid and current U.S. address is necessary for application and correspondence purposes.

- Phone Number and Email: Up-to-date contact information to facilitate communication regarding your application and account management.

Does the card have an annual fee?

No, the Wells Fargo Reflect credit card does not have an annual fee. This makes it a cost-effective option for those looking to benefit from its features and perks without worrying about an additional yearly charge.

Fees and Interest

The Wells Fargo Reflect credit card offers a competitive fee and interest rate structure designed to provide value to cardholders. Here’s a detailed breakdown of the fees and interest rates associated with the card:

1. Interest Rates

- Introductory APR: Enjoy a 0% introductory APR on purchases and qualifying balance transfers for up to 18 months from account opening. After the introductory period ends, the standard variable APR will apply.

- Standard APR: The standard variable APR for purchases and balance transfers ranges from 13.24% to 25.24%, depending on your creditworthiness.

- Cash Advance APR: The APR for cash advances is 29.99%, and interest starts accruing immediately from the date of the transaction.

- Penalty APR: If you make a late payment, the penalty APR may apply, which can be as high as 29.99%. This rate may apply indefinitely if you miss a payment.

2. Fees

- Annual Fee: $0. There is no annual fee, making this card a cost-effective option for those looking to avoid yearly charges.

- Balance Transfer Fee: During the introductory period, the balance transfer fee is 3% of the amount of each transfer, with a minimum of $5. After the introductory period, the fee is 5% of each transfer amount, with a minimum of $5.

- Cash Advance Fee: The fee for cash advances is either $10 or 5% of the amount of each advance, whichever is greater.

- Foreign Transaction Fee: The card charges a 3% fee on each transaction made in a foreign currency or made in U.S. dollars but processed by a foreign bank.

- Late Payment Fee: The late payment fee can be up to $40 if you miss a payment.

- Returned Payment Fee: If a payment is returned, you may be charged up to $40.

3. Additional Charges

- Over-the-Credit Limit Fee: There is no over-the-credit limit fee, but going over your limit could affect your credit score and result in declined transactions.

- Copy of Statement Fee: A fee may apply if you request a copy of a previous statement.

- Expedited Card Delivery Fee: There may be a fee if you request expedited delivery of your new or replacement card.

Is the card coverage international?

Card Flag

How to consult the invoice

Checking your Wells Fargo Reflect card statement is a simple process that can be done through various methods. Here’s a step-by-step guide to help you manage your account and stay on top of your finances:

1. Online Banking

- Log In: Visit the Wells Fargo website and log in to your online banking account using your username and password.

- Access Statements: Once logged in, navigate to the “Accounts” tab and select your Wells Fargo Reflect card account. Click on “Statements & Documents” to view your current and past statements.

- Download or Print: You can download or print your statements for your records or review them online.

2. Mobile App

- Download the App: If you haven’t already, download the Wells Fargo mobile app from the App Store (iOS) or Google Play (Android).

- Log In: Open the app and log in with your online banking credentials.

- View Statements: Select your Wells Fargo Reflect card account from the dashboard. Tap on “Statements & Documents” to view your statements.

- Convenience: The app allows you to check your statement anytime, anywhere, and even set up alerts for new statements.

3. Email Notifications

- Sign Up for E-Statements: Opt for electronic statements by signing up through your online banking account or mobile app. You will receive an email notification each time a new statement is available.

- Check Email: Open the email notification and click the provided link to access your statement directly.

4. Phone Banking

- Call Customer Service: Dial the Wells Fargo customer service number at 1-800-869-3557.

- Follow Prompts: Follow the automated prompts to navigate to the credit card services section.

- Request Statement Information: You can request information about your current statement balance, recent transactions, and payment due dates.

5. Paper Statements

- Receive by Mail: If you prefer, you can continue to receive paper statements by mail each month.

- Review Statements: When you receive your statement, review the transactions, balance, and payment due date. If you have any questions or notice discrepancies, contact Wells Fargo customer service.

By using these methods, you can easily stay informed about your Wells Fargo Reflect card account activity, monitor your spending, and ensure timely payments.

How to unlock the Wells Fargo Reflect Card

Activating your Wells Fargo Reflect credit card is a straightforward process that can be completed quickly through various methods. Here’s a step-by-step guide to help you activate your card:

1. Online Activation

- Log In: Visit the Wells Fargo website and log in to your online banking account using your username and password.

- Navigate to Card Services: Once logged in, go to the “Accounts” tab and select your Wells Fargo Reflect card. Look for the option to activate your card.

- Enter Details: Follow the prompts to enter the required information, such as the card number, expiration date, and the CVV code (the three-digit number on the back of your card).

- Confirm Activation: Submit the information to complete the activation process. You will receive a confirmation message once your card is activated and ready to use.

2. Mobile App Activation

- Download the App: If you haven’t already, download the Wells Fargo mobile app from the App Store (iOS) or Google Play (Android).

- Log In: Open the app and log in using your Wells Fargo online banking credentials.

- Activate Card: Select your Wells Fargo Reflect card account from the dashboard. Look for the activation option and follow the on-screen instructions to enter the required details.

- Complete Activation: Submit the information, and you will receive a confirmation that your card has been activated.

3. Phone Activation

- Call the Activation Number: Dial the Wells Fargo card activation number provided on the sticker attached to your new card. This number is typically toll-free.

- Follow Prompts: Follow the automated prompts to enter your card number, the last four digits of your Social Security number, and any other required information.

- Confirm Activation: Once you have entered all the necessary details, the system will confirm that your card is activated and ready for use.

4. ATM Activation

- Visit a Wells Fargo ATM: Go to a Wells Fargo ATM with your new Reflect card.

- Insert Card: Insert your new card into the ATM.

- Enter PIN: Follow the prompts to enter your Personal Identification Number (PIN). If this is your first time using the card, you may need to set up your PIN during this process.

- Complete Activation: After entering your PIN, your card will be activated, and you can perform a transaction if needed.

Additional Tips

- Set Up Online Banking: If you haven’t set up online banking with Wells Fargo, you can do so by visiting their website or using the mobile app. This will allow you to manage your card and account more effectively.

- Check for Confirmation: Always check for a confirmation message or email to ensure that your card has been successfully activated.

- Secure Your Card: Once activated, remember to sign the back of your card and store it securely.

Wells Fargo App: Control Your Reflect Card

The Wells Fargo mobile app offers a convenient way to manage your Wells Fargo Reflect credit card and other accounts on the go. Here’s a brief overview of its features and how to download it:

Features of the Wells Fargo Mobile App

- Account Management: View your Wells Fargo Reflect card balance, recent transactions, and payment due dates.

- Payments: Make payments to your credit card, transfer funds between Wells Fargo accounts, and pay bills.

- Alerts and Notifications: Set up and receive account alerts for payment due dates, transactions, and suspicious activity.

- Mobile Deposits: Deposit checks directly into your account using your smartphone’s camera.

- Card Control: Temporarily turn your card on or off if it’s lost or stolen, and set transaction limits.

- Rewards Tracking: Monitor your rewards points and redeem them directly through the app.

- Budgeting Tools: Access budgeting and spending tools to help manage your finances better.

- Customer Support: Easily contact customer support for assistance or locate the nearest Wells Fargo branch or ATM.

How to Download the Wells Fargo Mobile App

For iOS Users

- Open the App Store on your iPhone or iPad.

- Search for “Wells Fargo Mobile.”

- Tap “Get” to download and install the app.

- Once installed, open the app and log in with your Wells Fargo online banking credentials.

For Android Users

- Open the Google Play Store on your Android device.

- Search for “Wells Fargo Mobile.”

- Tap “Install” to download and install the app.

- After installation, open the app and log in with your Wells Fargo online banking credentials.

Wells Fargo Reflect Contact Channels

Wells Fargo offers several customer service channels to assist Wells Fargo Reflect cardholders. Here are the main options available for you to get help and support:

1. Phone Support

- Customer Service Number: Call 1-800-869-3557 for general inquiries, account information, and assistance with your Wells Fargo Reflect card. This number is available 24/7.

- Credit Card Support: For specific issues related to your credit card, such as lost or stolen cards, billing disputes, or payment problems, call 1-800-642-4720.

2. Online Banking

- Secure Messaging: Log in to your Wells Fargo online banking account and use the secure messaging feature to send inquiries and receive responses from customer service representatives.

- Live Chat: Access the live chat option through the Wells Fargo website or mobile app to get real-time assistance from a customer service agent.

3. Mobile App

- In-App Support: Use the Wells Fargo mobile app to manage your account and access customer support. You can find help through the app’s support section or use the secure messaging feature.

4. Email Support

- Email Correspondence: Send an email through your secure online banking account. Wells Fargo does not provide a direct email address for security reasons, but you can communicate securely through their online platform.

5. In-Person Assistance

- Branch Locations: Visit any Wells Fargo branch for face-to-face assistance. You can find the nearest branch using the Wells Fargo website or mobile app locator tool.

- ATM Services: Use Wells Fargo ATMs for various account services, including checking your balance, making payments, and more.

6. Social Media

- Twitter: Reach out to Wells Fargo’s customer service team via Twitter @Ask_WellsFargo for quick responses to general inquiries.

- Facebook: Message Wells Fargo on their official Facebook page for support and assistance with your queries.

7. Mail

- Mailing Address: Send mail inquiries to Wells Fargo Card Services, P.O. Box 51193, Los Angeles, CA 90051-5493. This method is suitable for non-urgent requests and document submissions.

By utilizing these various channels, you can get the help and support you need to manage your Wells Fargo Reflect card efficiently.