A Complete Guide to World2Cover Insurance Claims Process

Traveling is one of the best experiences in life. However, unexpected events can happen, and that’s where travel insurance makes all the difference.

Advertising

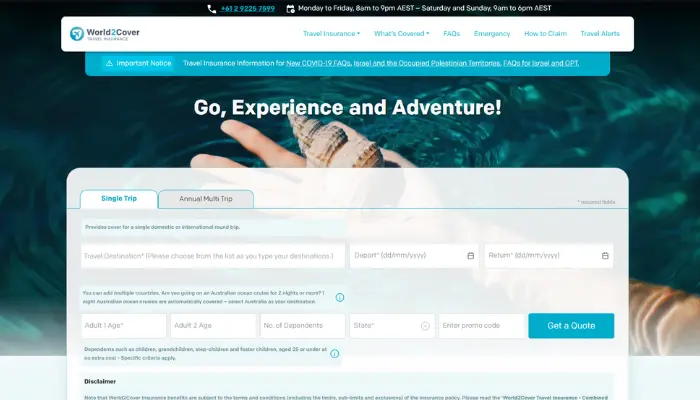

Today, let’s talk about World2Cover Travel Insurance, a travel insurance that offers comprehensive coverage and the security you need to enjoy your trips without worries.

Advertising

We’ll explore the main coverage points and how the insurance can protect you in different situations.

Coverage for Trip Cancellation

Nothing is more frustrating than having to cancel a long-awaited trip. If you’ve been through this, you know how costly and stressful it can be. With World2Cover Travel Insurance, you have the peace of mind of having coverage for trip cancellation.

Advertising

Cancellation coverage generally includes reasons such as illness, injury, family emergencies, or unexpected events like natural disasters. The insurance reimburses non-refundable expenses, ensuring you don’t suffer financial losses.

What’s covered?

- Non-refundable airfare expenses.

- Hotel reservations and prepaid travel packages.

- Prepaid activities and excursions.

Tip: To activate cancellation coverage, make sure to keep all documentation proving the reason for cancellation, such as medical reports or official communications.

Medical Coverage Abroad

One of the biggest fears of many travelers is needing medical care abroad.

Healthcare costs in other countries can be incredibly high, and that’s where World2Cover Travel Insurance stands out, offering comprehensive medical coverage to ensure you have access to the necessary assistance.

What’s included in medical coverage?

- Medical and hospital care expenses.

- Emergency medical transportation.

- Medical repatriation in severe cases.

Step-by-Step to Activate Medical Assistance Abroad:

Needing medical assistance during a trip abroad can be stressful, but World2Cover Travel Insurance ensures you receive the support you need. Here’s how to proceed if you need medical care while abroad:

- Contact the Call Center: Call the 24-hour World2Cover assistance center.

- Explain the Situation: Explain what happened and provide all necessary information, such as location and type of emergency.

- Follow Instructions: The support team will guide you to the nearest hospital or explain how to proceed to receive care.

Claims and Reimbursement Process

When something unexpected happens and you need to activate your insurance, it’s crucial to know what to do next. Understanding how the claims and reimbursement process works can save you time and reduce stress.

World2Cover Travel Insurance has a relatively simple process, but it’s essential to follow a few steps to ensure your request is approved without any issues.

The claims and reimbursement process is designed to be as straightforward as possible, but ensuring all necessary steps are properly completed will help you avoid any setbacks.

Whether it’s a medical expense, trip cancellation, or lost baggage, World2Cover aims to make the process smooth and hassle-free.

Step-by-Step to Claim Reimbursements:

- Gather Documentation: Collect all documents related to the event, such as receipts, medical reports, and incident reports. This documentation is crucial as it serves as proof of your claim.

- Fill Out the Claim Form: Access the World2Cover website and fill out the claim form, including all required information. Make sure all details are accurate to avoid delays.

- Submit the Documents: Submit the completed form and supporting documents through the indicated channels, such as email or the online portal.

- Track the Request: Periodically check the status of your claim until you receive the reimbursement. World2Cover provides updates, and you can also contact customer service if you need further assistance.

Coverage for Lost or Damaged Baggage

Losing baggage is one of the most inconvenient situations that can happen during a trip. With World2Cover Travel Insurance, you have coverage for lost, stolen, or damaged baggage, ensuring you are compensated for material losses.

What’s covered?

- Checked baggage that was lost by the airline.

- Damage to baggage during transport.

- Personal items stolen during the trip.

Tips to Facilitate the Claims Process:

Losing baggage can be stressful, but some actions can make the claims process simpler and more efficient. Check out some tips below:

- Always keep the baggage check receipts.

- In case of theft, file a police report at the local police station and keep a copy of the document.

Coverage for Flight Delays

Flight delays are frustrating and can disrupt your entire travel plan. World2Cover Travel Insurance offers coverage for expenses resulting from delays, such as meals, accommodation, and transportation.

What’s covered?

- Meals during the delay period.

- Accommodation if the delay exceeds a certain period.

- Alternative transportation to the final destination, if necessary.

How to Proceed in Case of Flight Delay:

Flight delays can cause significant discomfort and disruptions during your trip. Below, see how to act to ensure you are compensated for related expenses.

- Obtain a Document from the Airline: Request a document from the airline confirming the delay and the reason.

- Keep All Receipts: Keep receipts for additional expenses such as meals or accommodation.

- Contact the Insurance Call Center: Report the incident to receive guidance on the next steps.

Coverage for Sports Activities

If you’re an adventurer and love practicing sports during your trips, World2Cover Travel Insurance also offers coverage for various sports activities.

This is essential to ensure you are protected while practicing adventure sports, such as skiing, diving, surfing, among others.

Commonly Covered Activities:

- Skiing and snowboarding.

- Scuba diving (up to a certain depth).

- Hiking and trekking in safe locations.

Important: Always check the insurance terms and conditions to ensure the activity you want to practice is covered. Some more extreme activities may require additional coverage.

Customer Reviews and Experiences

When it comes to choosing travel insurance, the opinions of other customers make all the difference. Knowing that others have had positive experiences can provide a sense of security and confidence in your decision.

World2Cover Travel Insurance is well-rated for its comprehensive coverage and easy claims process.

What Customers Appreciate Most?

- Customer Service: Many customers highlight the excellent customer service, both during the purchase phase and for support during the trip.

- Reimbursement Process: Most customers report that the reimbursement process is quick and straightforward, as long as all necessary documentation is provided.

- Flexibility in Coverage: The flexibility to add specific coverage, such as for adventure sports, is a highly praised feature.

Tip: Read reviews on different platforms and insurance comparison sites to get a broader view of user experiences.

Traveling with peace of mind is essential for enjoying your journey to the fullest.

World2Cover Travel Insurance offers comprehensive coverage for the main unforeseen events, such as cancellations, medical emergencies, and lost baggage, allowing you to focus on making memories instead of worrying about potential issues.

With a straightforward claims process and flexible options, it is a reliable choice for travelers seeking safety and convenience.