Benefits of Allianz Global Assistance International Travel Insurance

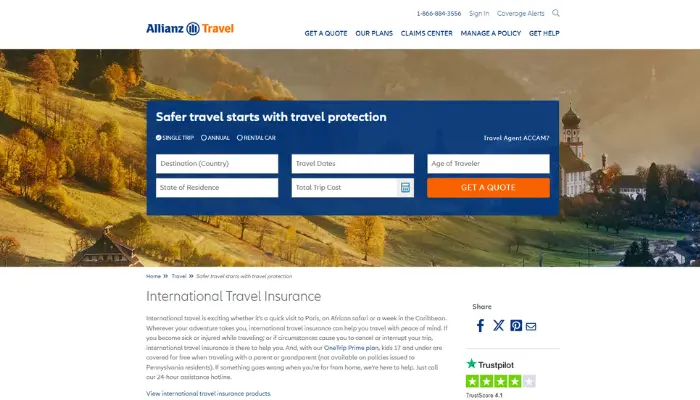

When it comes to travel, having a reliable insurance plan can offer the peace of mind you need. Allianz Global Assistance is one of the leading providers in the travel insurance industry, offering a range of options that cater to different types of travelers.

Advertising

Whether you’re going on a weekend getaway or an extended international trip, Allianz has coverage options that can help protect you from unexpected events.

Advertising

In this guide, we’ll explore the key benefits of Allianz travel insurance, walking you through the details of each type of coverage so that you can make an informed decision.

Trip Cancellation and Interruption Coverage

Travel plans don’t always go smoothly. You might have to cancel your trip due to unforeseen circumstances such as illness, severe weather, or even a family emergency.

Advertising

With Allianz Global Assistance, trip cancellation and interruption coverage helps protect your investment. Here’s how it works:

- Trip Cancellation Coverage: This reimburses you for prepaid, non-refundable expenses if you need to cancel your trip for a covered reason, such as illness or a death in the family.

- Trip Interruption Coverage: If your trip is interrupted (e.g., you have to cut it short due to an emergency), you can be reimbursed for unused, non-refundable expenses and additional travel expenses to return home early.

Step-by-Step Guide to Filing a Claim:

- Document Everything: Keep all receipts and documentation related to your trip, including invoices for flights, hotels, and other bookings.

- Report the Issue Immediately: If you need to cancel or interrupt your trip, notify Allianz Global Assistance as soon as possible.

- Submit a Claim: Use Allianz’s easy online claims portal to upload your documents and submit your claim.

Having this coverage ensures that even if the unexpected happens, you’re not left with the full financial burden.

Medical Coverage

Getting sick or injured while traveling can be both stressful and expensive, especially if you’re outside of your home country.

Allianz Global Assistance offers medical coverage to help travelers handle these situations without worry.

- Emergency Medical Coverage: Covers the cost of medical treatment if you get sick or injured while traveling, including hospital stays, surgeries, and doctor visits.

- Emergency Medical Evacuation: If the medical facilities in your location aren’t equipped to treat your condition, Allianz can arrange and cover the cost of emergency transportation to the nearest appropriate medical facility.

Why is Travel Medical Insurance Essential?

- High Costs of Healthcare Abroad: Medical costs can vary significantly by country, and in some places, they can be exorbitantly high. Without travel insurance, you could face unexpected and overwhelming bills.

- Limited Coverage by Health Plans: Most domestic health insurance plans don’t offer comprehensive coverage abroad, which makes travel insurance crucial for international trips.

If you’re traveling overseas, travel medical insurance from Allianz Global Assistance can save you thousands in unexpected healthcare expenses.

Lost or Delayed Baggage Coverage

Lost luggage can be a major inconvenience when traveling, but Allianz has you covered. Their baggage loss and delay coverage helps ensure that you’re compensated for lost, stolen, or delayed luggage.

- Lost Baggage: If your luggage is lost, Allianz will reimburse you for the contents of your bags up to a certain limit.

- Delayed Baggage: If your baggage is delayed for more than a set number of hours, Allianz can reimburse you for essential items like toiletries and clothing.

How to Handle Baggage Issues:

- File a Report: Immediately report any lost or delayed luggage to your airline and obtain written confirmation.

- Keep Receipts: If you have to buy essential items while waiting for your bags, keep all receipts so you can be reimbursed.

- Submit Your Claim: Once you’ve reported the issue to the airline, file a claim with Allianz Global Assistance to get reimbursed.

Travelers often forget about this coverage, but it can be incredibly useful when your trip is disrupted due to luggage problems.

Car Rental Coverage

If you plan to rent a car on your trip, Allianz Global Assistance offers rental car damage protection to cover you in case of accidents, theft, or damage to the vehicle.

- Collision Damage Waiver (CDW): This covers costs related to damage or theft of your rental car, potentially saving you from having to pay hefty repair bills.

- Towing and Roadside Assistance: If your rental car breaks down, Allianz can cover the cost of towing and assist with other roadside emergencies.

Benefits of Rental Car Coverage:

- Lower Out-of-Pocket Costs: Rental car companies often offer expensive insurance at the counter. With Allianz, you can secure more affordable coverage before your trip.

- Peace of Mind: Traveling with rental car coverage gives you confidence that you won’t face massive repair or replacement costs.

Whether you’re planning a road trip or simply renting a car for convenience, Allianz Global Assistance makes sure you’re covered on the road.

Annual Plans vs. Single Trip Plans

Allianz Global Assistance offers flexibility when it comes to choosing between annual plans and single trip plans. Here’s a breakdown to help you choose the right option:

Single Trip Plans:

- Best for Infrequent Travelers: Ideal if you only travel once or twice a year.

- Cost-Effective: You only pay for coverage during your specific trip dates.

Annual Plans:

- Best for Frequent Travelers: If you travel more than two or three times a year, an annual plan might save you money.

- Convenience: Covers all your trips for a full year, so you don’t have to worry about purchasing a new plan for every trip.

Which Plan is Right for You?

- If You Travel Once a Year: A single trip plan is more budget-friendly.

- If You Travel Multiple Times a Year: An annual plan offers better value and convenience.

24 Hour Assistance Services

Travel can be unpredictable, which is why having access to 24-hour assistance services is crucial. Allianz Global Assistance provides round-the-clock support for emergencies.

- Medical Assistance: If you need help finding a local hospital or arranging medical evacuation, Allianz is just a phone call away.

- Travel Assistance: Lost passport? Missed a flight? Allianz can help you navigate these stressful situations by offering support and guidance.

How to Access 24-Hour Assistance:

- Call the Hotline: Keep the 24-hour assistance number handy during your travels.

- Provide Your Policy Details: When calling for assistance, have your policy number and personal details ready.

No matter where you are in the world, Allianz ensures you’re never alone in a travel emergency.

Refund Process

One of the most important aspects of travel insurance is the claims process. Allianz Global Assistance makes it easy to submit a claim and get reimbursed for covered expenses.

Steps to File a Claim:

- Gather Your Documents: Ensure you have receipts, invoices, and any other required documents related to your claim.

- Submit Online: Allianz offers an easy-to-use online claims portal where you can submit your documents and track your claim.

- Get Reimbursed: Once your claim is approved, you’ll receive reimbursement directly to your bank account.

Allianz strives to make the claims process as seamless as possible, so you can focus on enjoying your trip, knowing you’re protected.

In conclusion, Allianz Global Assistance provides comprehensive travel insurance options that cater to a wide range of needs.

Whether you’re worried about trip cancellations, medical emergencies, or lost baggage, Allianz has you covered.

With their 24-hour assistance and simple claims process, you can travel with confidence, knowing you’re protected from the unexpected.