Discover the benefits of the Citi Diamond Preferred card and how to apply for it

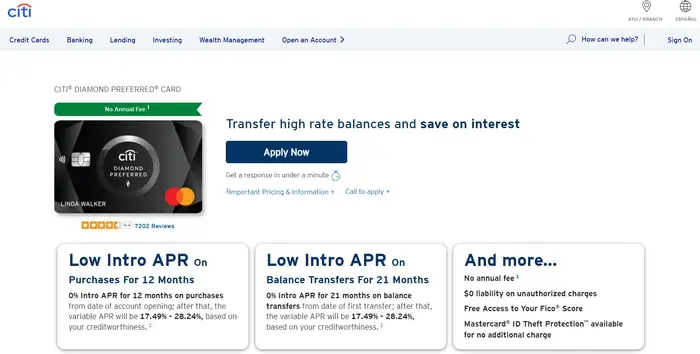

The Citi Diamond Preferred card is an excellent option for those looking for exclusive benefits and competitive rates. With benefits like a long introductory period of 0% APR on purchases and balance transfers, as well as advanced financial management tools, this card stands out among the options available on the market.

Advertising

In this article, you will discover the main benefits offered by the Citi Diamond Preferred and learn, step by step, how to request it quickly and easily.

How to Apply for the Citi Diamond Preferred Card

Advertising

Applying for the Citi Diamond Preferred card is simple and can be done quickly online. Follow the steps below to start the process:

Visit the Official Citi Website

- Go to Citi’s official credit card page: Citi Diamond Preferred.

Find the Citi Diamond Preferred Card

- On the credit card page, locate the section for the Citi Diamond Preferred card. Click on “Apply Now” to begin your application.

Fill Out the Application Form

Advertising

Provide the required information, including:

- Personal details (full name, address, phone number).

- Financial details (annual income, occupation).

- Social Security Number (SSN) for credit assessment.

Review and Submit Your Application

- Double-check all the information you’ve entered to ensure it’s accurate. Click “Submit” to complete your application.

Wait for Credit Review

- After submission, Citi will review your financial profile and credit history. The process may take a few minutes or a few days.

Receive a Decision

- If approved, you’ll receive confirmation via email, and the card will be mailed to the address provided during the application.

Who Can Apply for the Credit Card

To apply for the Citi Diamond Credit Card, applicants must meet the following eligibility criteria:

- Be at least 18 years of age

- Have a valid Social Security Number (SSN)

- Possess a good to excellent credit score (typically 670+)

Please note that meeting these requirements does not guarantee approval, as other factors such as income, credit history, and recent credit inquiries may also be considered.

Citi Diamond Card Preferred Benefits

The Citi Diamond Preferred card offers a combination of benefits that make it an attractive choice for those looking for savings and convenience. With a focus on competitive rates and exclusive benefits, it is ideal for balance transfers, planned purchases and efficient financial management. Below, we highlight the main benefits that make Citi Diamond Preferred a different option on the market.

Travel Benefits

Citi Diamond Credit Card offers a variety of travel benefits to make your trips more enjoyable and hassle-free. Cardholders can take advantage of:

- Complimentary Travel Insurance: Get coverage for trip cancellations, emergency medical expenses, and lost baggage when booking flights with the card.

- Airport Lounge Access: Enjoy complimentary access to selected airport lounges worldwide, providing a comfortable space to relax before a flight.

- Global Acceptance: The card is widely accepted, ensuring a seamless payment experience while traveling internationally.

Shopping Protections

With the Citi Diamond Credit Card, your purchases are protected, giving you peace of mind when shopping. Some of the shopping protection features include:

- Purchase Protection: Get coverage for items that are accidentally damaged or stolen within a specific period from the date of purchase.

- Extended Warranty: The card extends the manufacturer’s warranty on eligible items, providing an additional layer of protection.

- Price Protection: If a purchased item’s price drops within a certain time-frame, you may be eligible for a refund of the difference.

Exclusive Access

Being a Citi Diamond Credit Card holder means you’ll enjoy exclusive access to various events and experiences. These include:

- Concerts and Shows: Get pre-sale tickets and VIP access to popular concerts, theater productions, and other live entertainment events.

- Sports Events: Enjoy priority access to sports events, including special packages and experiences.

- Dining Experiences: Receive invitations to exclusive dining events hosted by renowned chefs and held at prestigious venues.

Overall, the Citi Diamond Credit Card offers a range of benefits and perks designed to enhance your travel, shopping, and entertainment experiences.

Reward System

The Citi Diamond Credit Card has an easy-to-understand reward system, focusing on providing value for cardholders:

- Cash Back: Earn a flat rate of 1% cash back on all purchases, with no caps or category restrictions.

- No Expiry on Rewards: Accumulated cash back rewards do not expire as long as the account is open and in good standing.

Does the card have a free annual fee?

The Citi Diamond Credit Card offers its impressive lineup of features and benefits without burdening cardholders with additional fees:

- No Annual Fee: Cardholders can enjoy all the benefits without the worry of an annual fee.

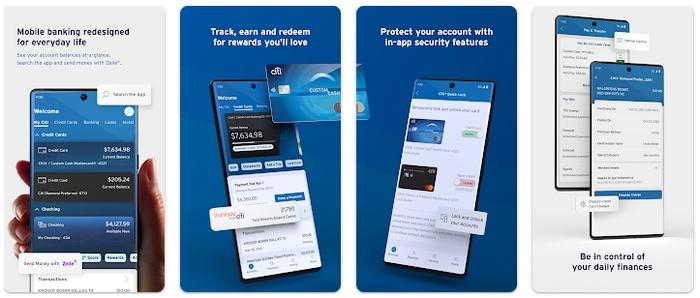

How to Download the Citi Mobile App

The Citi Diamond Preferred card app is an essential tool for managing your finances in a practical and secure way. With it, you can access important information such as your available balance, credit limit, detailed invoices and transaction history, all in one place. Additionally, the app allows you to set up alerts to monitor expenses, make payments quickly and even request customer support.

How to Download

For Android Devices:

- Access the Google Play Store on your cell phone.

- Search for “Citi Mobile” in the search bar.

- Click “Install” to download and install the application.

For iOS Devices:

- Open the App Store on your iPhone.

- Search for “Citi Mobile”.

- Tap “Get” to begin download and installation.

After installation, simply log in with your Citi credentials to access all of the app’s features and manage your Citi Diamond Preferred card efficiently and conveniently.

What are the fees and interest on the Citi Diamond Preferred card?

The Citi Diamond Card comes with a variety of fees and interest rates that are important to understand. There may generally be an annual fee, although some versions of the card may offer a fee waiver for the first year.

Card interest rates may vary depending on credit quality and market conditions. These fees apply to purchases, balance transfers, and cash advances. Additionally, the card may include other fees, such as:

- Late Payment Fees

- Foreign Transaction Fees

- Balance transfer fees

That’s why it’s important to check the terms and conditions for specific details.

How to unlock the card?

Unlocking your Citi Diamond card is a simple process. If your card is blocked due to security concerns or lost, you can easily unlock it through the Citi mobile app or by logging into your online account.

In some cases, you may need to contact customer service for assistance, especially if the block is due to suspected fraudulent activity. It’s always a good idea to resolve any issues with your card immediately to ensure the security of your account.

How do I request a duplicate of the card?

If you need a duplicate of your Citi Diamond card, you can easily request it through several channels. The most convenient way is through the Citi mobile app or your online account:

- In the services section, you can report lost or damaged card and request a replacement.

Alternatively, you can call the Citi customer service hotline for assistance. The replacement process is usually quick and you should receive your new card within a few business days.

How do I contact you about the Citi Diamond card?

Here are some ways to contact the Citi Diamond Card:

Telephone: 1-800-695-5164. Available 24 hours a day, 7 days a week.

Chat: Visit the Citibank website and select the “Chat” option in the bottom right corner of the screen.

Mail: Citibank, N.A., P.O. Box 6500, Sioux Falls, SD 57117-6500

If you are calling from the US, you can use any of these numbers. If you are calling from another country, you will need to use your home country’s international access code. For example, if you are calling from Brazil, the number would be 001-800-695-5164.

When contacting Citibank, be sure to have the following information ready:

- Your name and account number

- The subject of your message

- A detailed description of your problem or question

- You can also attach documents or files to help Citibank better understand your issue.

Citibank will respond to your message as soon as possible.

Here are some examples of topics you can discuss with Citibank:

- Problems with your account, such as incorrect charges or late invoices.

- Questions about your card benefits, like rewards or insurance.

- Account change requests, such as changing your address or phone number.

- Complaints about customer service.

If you have an urgent issue, please contact Citibank by phone. Telephone support is available 24 hours a day, 7 days a week.