Chime Credit Builder Secured: Is It Worth It for Building Credit?

Building a good credit history in the United States can be challenging, especially for beginners or those who have faced financial difficulties in the past. Traditional credit cards often come with high fees and strict approval requirements, making the process even harder. But what if there was an accessible, interest-free solution that actually helped improve your credit score?

Advertising

The Chime Credit Builder Secured emerges as an innovative alternative for those looking to build credit simply and without risks. With a different model from conventional cards, it offers unique advantages, such as no fees and no impact on your credit score when applying. In this article, we’ll explore all the details of this card, its benefits, and how it can be a powerful tool to boost your credit score.

What Is the Chime Credit Builder Secured?

Advertising

The Chime Credit Builder Secured is an innovative credit card designed for those who want to build or improve their credit score in the United States. Unlike traditional credit cards, it operates without interest and without hard inquiries on your credit history.

Advertising

This card works as a secured credit card, but with an important difference: instead of requiring a fixed security deposit, it allows users to set their own credit limit based on the funds available in their Chime account. This eliminates the risk of excessive debt and provides greater financial control.

Additionally, the Chime Credit Builder has no annual fee, making it an affordable option for those looking to improve their credit score without extra costs. Payments are reported to the three major credit bureaus (Experian, Equifax, and TransUnion), helping to create a positive payment history and increase the credit score over time.

How Does the Chime Credit Builder Work?

This card operates like a secured credit card, but without many of the disadvantages associated with such products. Here’s a step-by-step guide:

- Initial Deposit: Instead of a predefined credit limit, users need to add funds to a Chime account to set their own spending limit.

- Card Usage: The Chime Credit Builder can be used anywhere Visa is accepted, allowing you to make purchases as usual.

- Reported Payments: Chime reports payments to the three major credit bureaus (Experian, Equifax, and TransUnion), helping to build credit history.

- No Interest: Since you only use money you’ve already deposited, there are no interest charges.

- No Hard Inquiry: Applying for the card does not impact your credit score.

Key Benefits of the Chime Credit Builder

This card stands out for its unique advantages. Here are the main benefits:

- No annual fee – Zero extra charges to maintain the card.

- No interest – Use only the money you’ve added.

- No credit check – Great for those starting out or rebuilding credit.

- Reports to credit bureaus – Helps improve your credit score.

- No fixed spending limit – You set your own limit based on available funds.

How to Apply for the Chime Credit Builder Secured

Applying for the Chime Credit Builder is simple and can be done online. Here’s how:

- Open a Chime Account – You need a Chime account to qualify for the card.

- Set Up Direct Deposit – Add funds to your Chime account to establish your credit limit.

- Apply for the Card – Once you meet the requirements, you can apply for the Credit Builder directly through the app.

- Activate and Start Using – When you receive your card, activate it and begin using it to build your credit.

Chime Credit Builder Secured App

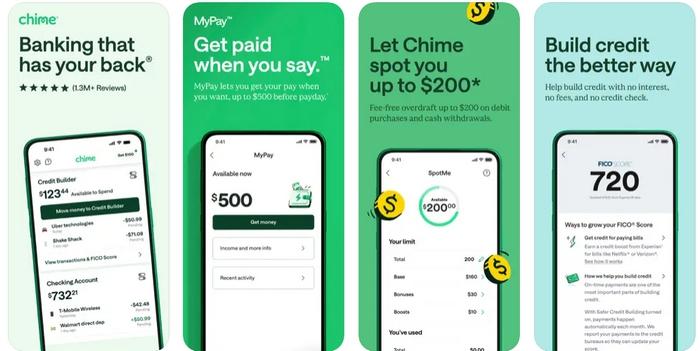

To make managing your card easier, Chime offers an intuitive and easy-to-use app. With it, you can track your spending, set payment reminders, and monitor your credit score.

Another great feature is the ability to receive instant notifications about transactions and credit score updates, ensuring complete control over your finances.

How to Download the Chime App

The Chime app is available for both Android and iOS devices. Follow the steps below to download it:

- Go to the app store:

- For Android users, visit the Google Play Store.

- For iOS users, visit the App Store.

- Search for “Chime – Mobile Banking”.

- Click “Install” or “Download“.

- Once installed, open the app and log in using your Chime credentials.

- Enable notifications to receive payment reminders and account updates.

With the app, you can easily manage your card, ensuring that you always stay in control of your credit.

Who Is the Chime Credit Builder For?

This card is ideal for:

- Credit beginners who don’t want to deal with hard inquiries.

- People looking to rebuild credit without the risk of debt.

- Anyone wanting to avoid high interest and fees common with traditional credit cards.

Strategies to Maximize Credit Building with Chime

If you want to use the Chime Credit Builder effectively, follow these strategies:

- Always pay on time – Since payments are reported, late payments can negatively impact your score.

- Use it regularly – Small, frequent purchases help demonstrate good credit usage.

- Maintain a healthy balance – Avoid spending your entire limit at once.

- Enable automatic payments – This way, you never miss a due date.

Does the Chime Credit Builder Really Help Build Credit?

Yes! Many users report a significant increase in their credit score after a few months of use. A study by Chime itself revealed that 90% of users saw an increase in their score after using the card correctly.

Is the Chime Credit Builder Worth It?

If you’re looking for a safe, interest-free, and fee-free way to build credit in the U.S., the Chime Credit Builder Secured is an excellent choice. It offers exclusive benefits that make it a superior option compared to many traditional secured credit cards.