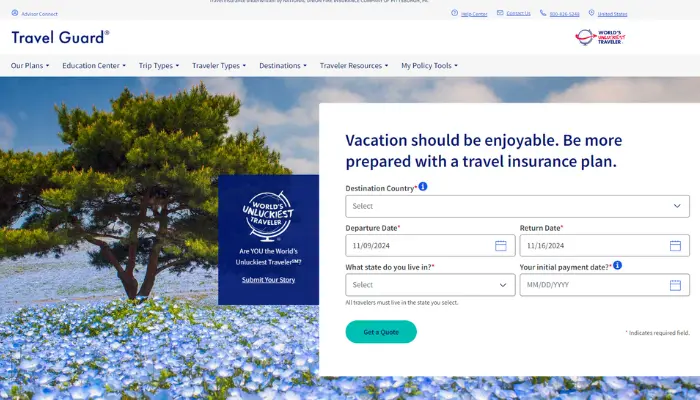

How Travel Guard by AIG Ensures Stress-Free Travel Planning

Traveling is one of the most exciting experiences in life. Discovering new places, exploring different cultures, and creating unforgettable moments are reasons why people love to travel.

Advertising

However, unforeseen events can happen, and it’s essential to be prepared to handle them. Travel Guard by AIG is an insurance that offers a range of coverages to ensure that, even in unexpected situations, you can enjoy your trip with peace of mind.

Advertising

This article presents the main coverages offered by Travel Guard and how they can be essential for your safety and peace of mind during your adventures.

Trip Cancellation Coverage

With Travel Guard by AIG, you can feel secure when planning your trip, knowing that you are protected if unforeseen events occur. Canceling a trip can be frustrating, especially after all the planning and investments made.

Advertising

However, the insurance offers the possibility of reimbursement in situations such as illness, accident, family emergencies, and other unexpected occurrences.

To request a reimbursement, you would need to follow these steps:

- Contact the Travel Guard customer service center – they will guide you on which documents are required.

- Gather the documents – this may include medical reports, proof of payment, and other evidence justifying the cancellation.

- Fill out the reimbursement form – the form is available online and is quick to complete.

- Submit everything for review – after that, the Travel Guard team will analyze the documents to ensure you are reimbursed.

Emergency Medical Coverage

Being in a foreign country and needing medical care can be a scary and costly experience.

The emergency medical coverage from Travel Guard by AIG helps reduce this concern. If you need urgent hospital care, the insurance covers the costs associated with medical expenses, medication, and hospitalization.

This coverage is essential, as many countries have expensive healthcare systems, and medical expenses could drastically impact your travel budget.

With Travel Guard, you can travel with peace of mind knowing that you are protected against health emergencies.

Lost or Delayed Baggage Insurance

Losing your luggage is one of travelers’ worst nightmares, which is why Travel Guard offers coverage for lost or delayed baggage.

Imagine arriving at your dream destination only to discover that your suitcase did not make it – it’s a frustrating situation, but the insurance ensures you are not left helpless.

Travel Guard by AIG reimburses the cost of essential items you need to purchase while your luggage is missing or delayed. This includes basic clothing and personal hygiene items, ensuring you can continue your trip with minimal inconvenience.

Additionally, if your luggage is considered lost, the insurance also reimburses the value of your belongings.

Trip Interruption Reimbursement

If you are already traveling and need to interrupt your trip due to an emergency, Travel Guard also offers coverage for that.

Whether it’s due to a health problem or a family emergency, interruption coverage ensures that you receive reimbursement for unused expenses, such as hotel nights you won’t be able to enjoy or pre-paid tours.

The reimbursement process works like this:

- Immediately inform the insurer about the interruption.

- Provide the necessary documents – this may include medical reports, cancellation proofs, and other documents justifying the interruption.

- Request the reimbursement – fill out the request form and submit it to the insurer for analysis.

This way, you minimize your financial losses and can focus on what is most important at the moment.

Travel Guard Plan Options

Travel Guard by AIG offers several plan options to meet the specific needs of each traveler. Whether you’re planning a short or long trip, a business trip, or leisure, Travel Guard has a plan that suits your profile.

The plans range from basic coverages, which protect against cancellations and medical emergencies, to more comprehensive plans that include additional coverages such as baggage insurance, 24-hour assistance, and more.

Additionally, you can customize your plan by adding extra coverages according to your needs.

Here are some of the most popular plan options:

- Basic Plan: Focused on trip cancellation coverage and medical assistance.

- Comprehensive Plan: Includes cancellation, medical emergency, lost baggage, and more.

- Family Plan: Ideal for those traveling with family and wanting to ensure protection for everyone.

24-Hour Assistance

No matter where you are in the world, Travel Guard by AIG offers 24-hour assistance. This means that if any unforeseen event occurs during your trip, you have a reliable point of support available at any time.

Whether it’s a medical emergency, a problem with your flight, or a question about your coverage, someone will always be ready to assist you.

Here are some of the key benefits of the 24-hour assistance service:

- Medical Emergencies: Immediate support for finding hospitals, arranging medical treatment, and coordinating payments.

- Travel Issues: Assistance with missed flights, rebooking, and coordinating with airlines.

- Lost Documents: Help in case you lose important travel documents, such as passports.

- General Guidance: Support for any questions regarding your insurance coverage or how to proceed in unexpected situations.

The 24-hour assistance is designed to make your travel experience as smooth as possible. Just call the customer service center, and you will receive guidance on how to proceed in any unexpected situation.

This type of service is extremely valuable when you are abroad, away from the comfort of home and your usual routines.

Special Activities Coverage

For adventurers, it is crucial to ensure that extreme activities are adequately covered during travel. Travel Guard by AIG offers coverage for a wide range of special activities, including winter sports, diving, hiking, and more.

Many traditional insurance policies often exclude these types of activities, leaving travelers vulnerable. With Travel Guard, you have the freedom to pursue your adventures without worrying about potential risks.

Here are some of the key special activities covered by Travel Guard:

- Winter Sports: Coverage for skiing, snowboarding, and other snow activities.

- Water Sports: Includes activities like diving, snorkeling, and jet skiing.

- Hiking and Trekking: Protection during hiking, trekking, and mountain climbing adventures.

- Adventure Sports: Coverage for bungee jumping, zip-lining, and other high-adrenaline activities.

- Cycling and Mountain Biking: Coverage for cycling tours and mountain biking trips.

To make sure you are fully protected, follow these steps:

- Check Your Plan: Review your insurance plan to see which activities are included.

- Add Extra Coverage: If the activity you plan to participate in is not covered, add additional coverage to your plan.

- Stay Informed: Contact Travel Guard to understand the terms and limitations for each activity.

With the right coverage, you can embark on your adventures confidently, knowing that in case of an accident, all medical and rescue expenses will be taken care of.

For adventurers, it is important to ensure that extreme activities are covered. Travel Guard by AIG offers coverages for various special activities, such as winter sports, diving, hiking, and more.

This is particularly relevant, as many traditional insurance policies do not include these types of activities, leaving travelers unprotected.

With Travel Guard, you can venture without fear. Make sure to check which activities are included in your plan, and if necessary, add extra coverage for the activity you plan to practice.

This way, you ensure that in case of an accident, all medical and rescue expenses will be covered.

Conclusion

Traveling is an enriching experience, but having the right protection makes all the difference in ensuring that moments of fun are not affected by unforeseen events.

Travel Guard by AIG offers a wide variety of coverages ranging from cancellations and medical emergencies to insurance for specific activities and 24-hour assistance.

Choose the plan that best suits your needs and travel with peace of mind, knowing that if something goes wrong, you will be protected.