U.S. Bank Cash+ Secured Visa Card: Complete Guide to Rebuilding Credit and Earning Cashback

If you’re looking for a safe way to rebuild your credit while earning cashback on everyday purchases, the U.S. Bank Cash+ Secured Visa Card could be the ideal solution.

Advertising

In this guide, we’ll explain everything you need to know about this card: how it works, its benefits, how to apply for it and tips to make the most of it. Let’s go?

Discover the U.S. Bank Cash+ Secured Visa Card

Advertising

The U.S. Bank Cash+ Secured Visa Card is a secured credit card designed to help people who want to build or rebuild their credit history. Unlike a traditional card, it requires a security deposit, which serves as a guarantee and defines your credit limit.

Advertising

But what makes this card special is the cashback program, which allows you to earn cash back in categories chosen by you. This makes it a great option for anyone looking to improve their credit without giving up financial benefits.

How does the U.S. Bank Cash+ Secured Visa Card Work?

1. Security Deposit and Credit Limit

To open an account, you need to make a security deposit ranging from 300to5,000. This amount defines your credit limit. For example, if you deposit 500,yourcreditlimitwillbe500.

2. Cashback Program

The card offers cashback in categories you select. Here’s how it works:

- 5% cashback in two categories of your choice (such as restaurants, groceries, or transportation).

- 2% cashback in a pre-defined category (like drugstores or gas stations).

- 1% cashback on all other purchases.

3. Credit Reporting

U.S. Bank reports your card usage to the three major credit bureaus (Equifax, Experian, and TransUnion). This means that by using the card responsibly, you can improve your credit score over time.

Benefits of the U.S. Bank Cash+ Secured Visa Card

Why choose this card? Here are the main benefits:

- Credit Rebuilding: Ideal for those looking to improve their credit score.

- Customizable Cashback: Choose categories that best fit your lifestyle.

- No Credit Check Required: Since it’s a secured card, you don’t need a strong credit history to get approved.

- Mobile Banking Access: Manage your account through the U.S. Bank app.

- Fraud Protection: Advanced security for your transactions.

How to Apply for the U.S. Bank Cash+ Secured Visa Card

Applying for the card is simple. Follow these steps:

- Check the Requirements: You must be over 18 years old, have a Social Security Number (SSN), and a security deposit between 300and5,000.

- Visit U.S. Bank’s Website: Fill out the online application form – cashplus.usbank.com.

- Make the Deposit: After approval, make the security deposit to activate your credit limit.

- Receive Your Card: Your card will arrive by mail in a few days.

Tips to Maximize Cashback

Want to earn more cashback? Try these strategies:

- Choose Categories You Use Most: If you spend a lot on restaurants and groceries, select those categories to earn 5% cashback.

- Take Advantage of Rotating Categories: Every quarter, you can change your cashback categories. Keep an eye on promotions!

- Use the Card for All Purchases: Even on purchases that earn 1% cashback, every penny counts.

U.S. Bank Cash+ App: How to Download and Use to Manage Your Card

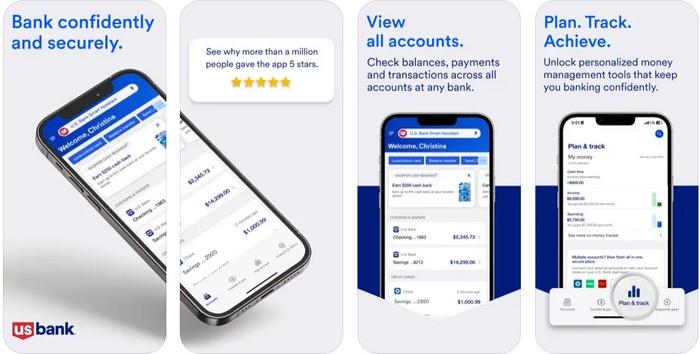

The U.S. Bank Cash+ app is an essential tool for anyone with the U.S. Bank Cash+ Secured Visa Card. With it, you can manage your account, track spending, pay bills, check your cashback, and much more, all directly from your phone. Let’s teach you how to download the app and make the most of its features.

Key Features of the U.S. Bank Cash+ App

The app is designed to make your financial life easier. Check out some of its most useful features:

- Spending Tracking: View all your transactions in real-time, organized by category.

- Bill Payments: Pay your bill directly through the app, no computer needed.

- Cashback Tracking: Monitor how much cashback you’ve earned and in which categories.

- Custom Notifications: Receive alerts about due dates, suspicious transactions, and promotions.

- Credit Limit Management: Check your available credit limit and payment history.

- Customer Support: Access quick help via chat or phone directly through the app.

How to Download the U.S. Bank Cash+ App

Downloading the app is simple and fast. Follow the steps below based on your device:

For Android Devices:

- Open the Google Play Storeon your phone.

- In the search bar, type “U.S. Bank Mobile App”.

- Locate the official U.S. Bank app (with the blue and white icon).

- Click “Install” and wait for the download to complete.

- After installation, open the app and log in with your U.S. Bank account credentials.

For iOS Devices (iPhone):

- Open the App Store on your iPhone.

- In the search bar, type “U.S. Bank Mobile App”.

- Find the official U.S. Bank app (blue and white icon).

- Tap “Download” and wait for the installation to finish.

- Open the app and enter your login and password to access your account.

Tips for Using the App Efficiently

- Enable Notifications: This helps you never miss a payment due date and monitor transactions in real-time.

- Use the Budgeting Tool: The app allows you to categorize your spending, helping you better manage your finances.

- Check Your Cashback Regularly: Track how much you’re earning and adjust your cashback categories if needed.

- Set Up Automatic Payments: Avoid late fees by setting up automatic bill payments.

How the Card Helps Rebuild Your Credit

Using the U.S. Bank Cash+ Secured Visa Card responsibly can improve your credit score. Here’s how:

- Pay Your Bills on Time: Timely payments are the most important factor in improving your credit.

- Keep Credit Utilization Low: Try to use less than 30% of your credit limit.

- Monitor Your Progress: Use tools like Credit Karma to track your credit score.

Fees and Costs of the Card

Before applying, it’s important to know the fees involved:

- Annual Fee: $0 (yes, it has no annual fee!).

- Interest Rate: Variable, depending on your profile.

- Late Payment Fee: Up to $40.

- Foreign Transaction Fee: 3% of the purchase amount.

Is the U.S. Bank Cash+ Secured Visa Card Worth It?

If you’re looking for a card that combines credit rebuilding with financial benefits, the U.S. Bank Cash+ Secured Visa Card is an excellent choice. It offers generous cashback, no annual fee, and effectively helps improve your credit score.

Ready to Rebuild Your Credit?

The U.S. Bank Cash+ Secured Visa Card is a powerful tool for those looking to improve their credit while earning cashback. With customizable cashback categories and regular reporting to credit bureaus, it’s a smart option for anyone seeking financial control and real benefits.

Ready to take the first step? Apply for your U.S. Bank Cash+ Secured Visa Card today and start rebuilding your credit while earning cashback! Click here to sign up.