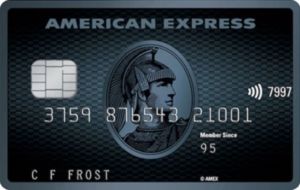

Learn all about applying for the American Express Explorer Credit Card

The American Express Explorer Credit Card in Australia is a popular credit card that offers a range of benefits and rewards to its users. With its generous rewards program, this credit card is a great option for those who want to earn points on everyday purchases, as well as travel-related expenses.

Advertising

One of the key benefits of the American Express Explorer Credit Card is its rewards program, which allows users to earn points on eligible purchases. These points can be redeemed for a range of rewards, including travel, shopping, and dining experiences. In addition, the card also offers a range of other benefits, such as complimentary travel insurance and access to exclusive events.

Card Features

Advertising

The American Express Explorer Credit Card offers a range of features that make it an attractive option for those looking for a credit card with rewards, travel benefits, insurance cover, and competitive interest rates and fees.

- Rewards Program: The Explorer Credit Card rewards program offers cardholders the opportunity to earn Membership Rewards points on eligible purchases. Cardholders can earn 2 Membership Rewards points per $1 spent on eligible purchases, except for government bodies where they earn 0.5 points per $1 spent. The points can be redeemed for a range of rewards, including travel, shopping, entertainment, and more;

- Travel Benefits: The Explorer Credit Card offers several travel benefits, including a $400 annual travel credit which can be used towards flights, hotels, car rentals, and more. Cardholders also get complimentary access to the American Express Lounge at Sydney International Airport and Melbourne International Airport;

- Insurance Cover: The Explorer Credit Card comes with a range of insurance covers, including overseas travel insurance, purchase protection insurance, and extended warranty insurance. The overseas travel insurance covers cardholders for medical expenses, trip cancellations, and lost or stolen luggage when traveling overseas. The purchase protection insurance covers eligible items purchased with the card for up to 90 days from the date of purchase against loss, theft, or accidental damage. The extended warranty insurance extends the manufacturer’s warranty on eligible items purchased with the card for up to 12 months.

Interest Rates and Fees

The Explorer Credit Card has a competitive interest rate of 20.74% p.a. on purchases, and a cash advance interest rate of 22.74% p.a. The card has an annual fee of $395 p.a. which is offset by the $400 annual travel credit. The card also has a minimum credit limit of $3,000.

Advertising

Overall, the American Express Explorer Credit Card offers a range of features that make it an attractive option for those looking for a credit card with rewards, travel benefits, insurance cover, and competitive interest rates and fees.

How to apply for the American Express Explorer Credit Card

To apply for the American Express Explorer credit card in Australia, the applicant can visit the American Express Australia website and click on the “Apply now” button. The application form requires personal information, contact details, employment status, and financial details such as personal and household income and expenses. The applicant can also add an additional cardholder during the application process. The application process is quick and easy, taking only a few minutes to complete.

Credit Score Requirements

To be eligible for the American Express Explorer credit card, the applicant needs to have a good to excellent credit score. According to Finty, any credit score that is anywhere from “Good” to “Excellent” may make an applicant eligible for the card. In Australia, credit scores are allocated by the three credit bureaus, Experian, Equifax, and illion. Both Experian and Equifax regard a score of around 625 or more as “Good,” while for illion it’s 500+.

Income Requirements

The American Express Explorer credit card has a minimum income requirement of $65,000 per annum. However, the actual income requirement may vary depending on the applicant’s financial circumstances. The credit limit offered to the applicant will also depend on their income, credit score, and other factors. It is essential to provide accurate financial information during the application process to ensure the credit limit offered is suitable for the applicant’s needs.

Overall, the American Express Explorer credit card is an excellent choice for those who want to enjoy great travel benefits and earn rewards points on eligible purchases. With a quick and easy application process, good to excellent credit score requirements, and a minimum income requirement of $65,000 per annum, the Explorer credit card is a great option for those who meet the eligibility criteria.

How to download the Card application

The American Express Explorer application is an essential tool for American Express Explorer credit card holders. The application offers a variety of features that allow cardholders to manage their credit card conveniently and easily.

To download the American Express Explorer app, follow these steps:

- Open the App Store or Google Play Store on your mobile device;

- Search for “American Express Explorer”;

- Tap on the American Express Explorer app icon;

- Tap “Get” or “Install”;

- Follow the on-screen instructions to complete the download.

How to get a duplicate American Express Explorer card

If your American Express Explorer card is lost, stolen or damaged, there’s no need to worry. You are not responsible for fraudulent purchases. Here’s how to request a replacement card:

- Online: Visit American Express Card Replacement and request a replacement card. American Express will cancel your lost or stolen card and send you a new one. It’s quick, easy and free.

- Delivery options: You can choose from several delivery options, including free next-day shipping.

- Recurring payments: If you use your card for recurring payments (e.g. cell phone charges), there’s no need to update merchants unless specifically requested.

- Digital wallets: If you have added your card to a digital wallet (e.g. Apple Pay, Samsung Pay), you can continue to use it while waiting for the new physical card12.

American Express card contacts in Australia

For general inquiries, you can talk to American Express 24/7 via the American Express app or your online account.

Here are the specific contact details for some American Express cards in Australia:

American Express Explorer credit card:

- Australia: 1800 059 388

- Overseas: +612 9271 4011

Citibank Australia is committed to resolving disputes in a fair, efficient and timely manner. If you have a complaint, you can contact the Customer Service Centre on 13 24 84 or +61 2 8225 0615 (if you are calling from overseas).

If your complaint is not resolved to your satisfaction, you can escalate it to Citibank Australia’s Internal Dispute Resolution (IDR) team. The IDR team will investigate your complaint and provide you with a written response within 45 days. You can contact the IDR team by mail at:

Citibank Australia Internal Dispute Resolution GPO Box 40 Sydney NSW 2001.